Partner article

What is the cashback and how to get it We understand how the cashback works and in which banks to get the maximum refund of the money

What is the cashback?

Cashback — is the refund of part spending funds back to your bank card.

For example, balance of your card is ₴5 000 and the cashback is 2%. You purchased in shop for ₴600. Then, you need to have ₴4 400 on your bank card. But instead, you will have ₴4 412. ₴12 - is the cashback from the bank — the sum, which was returned on your account out of ₴600.

It`s worth noting, that in many banks from the cashback account (in our example it is ₴12) income or another taxes are in charge, which were established by the government, in view of the fact, that ₴12 — is your income.

I have already bonus cards in many shops and favorite restaurants. Why do i need cashback?

The difference between cashback and bonus cards of shops and restaurants is that cashback will return as real money to your bank card. There is no any differences from your funds on the card. The money that is returned to your card stores or restaurants under the bonus program can only be spent in these stores or restaurants.

Of course you can spend both bonus program and cashback from bank at the same time.

Where the cashback is taken and why the bank share money with me?

The bank gets commissions from payment systems (Visa, Master Card and other) for your transactions (when you reckon in the restaurant or shop). Instead of taking these commissions to themselves, the bank gives them to the client, thereby motivating them to continue paying with their card.

In order for using this card, you should have some sum. This sum is never underutilized. Bank use it for lending or investing. It doesn’t mean bank take your money. It uses all the funds that customers keep with him to earn. But at any time the bank will give you to use your money (pay with a card or withdraw cash). Making the money work, the bank also earns. And share the profits with you.

In what bank I can process the card with cashback?

Today almost every bank has such cashback system. Choosing bank, pay attention not only to the cashback size, but also, for example, the monthly cost of servicing this card, the percentage of cash withdrawals and other services.

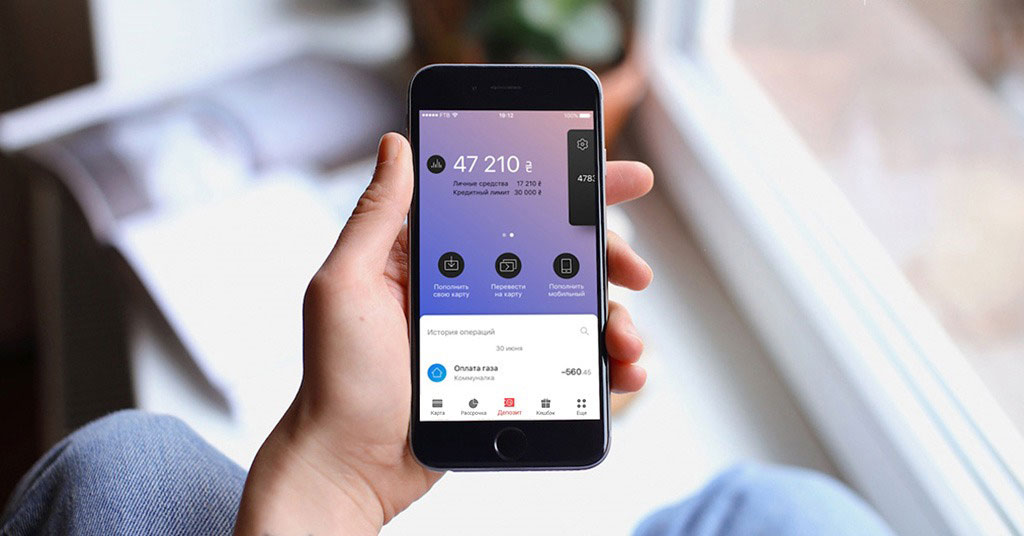

In 2019 in Ukraine, the Monobank card is the coolest card for receiving cashback, and generally just for personal use.

It is very easy to get this card - you need only instal application, make photo of your documents and order the delivery card home or pick up at the point of issue in any city.

Each new customer Monobank gives 50 UAH in the form of cashback, if you are invited by an existing customer. Therefore, if you follow the link from the author of this article (who is already a Monobank client), enter the phone number, install the application and become a Monobank client, you will have 50 UAH on your card.

In the future, when you will be client of Monobank, your friends could get 50 UAH for registration at your invitation.

When you will start to use your card, you will know all advantages: free service, free money transfers into the same card another person, cash withdrawal at any ATM of Ukraine for 0.5% of the amount (for 2019 this is the lowest cash withdrawal rate), and of course that same cashback we talked about.

Another banks in Ukraine also have cashback system. Their schemes is not usually easy for understanding or there are limited points in which cashback can be obtained.

Here is some ukrainian banks, there are some good terms of service and cashback: Alfa-Bank, Oschadbank, Tascombank.

The biggest bank of Ukraine — is Privat Bank — it doesn’t share cashback system.

Do i need necessarily use card for getting cashback? What about online shopping?

There are some conditions cashback charges in every bank. In the above-above mentioned Monobank, every month you can choose 2 categories, in which you would like to get cashback. For example, in the categories “Auto and petrol station” and “Food, supermarkets”. According to the terms of the bank, in these categories the cashback is 3% and 2%, respectively. So, paying for goods from these categories in any way, you will receive a cashback: a purchase at an offline store, a purchase at an online store, a purchase paid by Google Pay or Apple Pay.

Even on games in the AppStore application store, this also applies. By the way, purchases in the AppStore fall under the category of "Entertainment, Sports."

What about such sites as LetyShops or some same? They also offer cashback. What is the difference between such sites and bank`s cashback?

Besides banks, there are cashback-servises, such as LetyShops, PayBack and other, which get you cashback for online shopping. In this services there are more shops, categories, on which you can receive cashback. But also there are more rules which you need to follow, to get part of money back.

So what do i need to choose?

Try to remember which categories of goods you spend more money on in recent months; whether you made purchases online or offline. Just think about whether you are ready to actively monitor stores where you need to make purchases in order to get the maximum benefit, or you agree to a cashback, which is simply charged as a background.

Answers to these questions will help you decide what you will enjoy most comfortably. Bargain shopping!