Donald Trump’s stated mission to end the war in Ukraine, as noted by The Guardian, comes down to a single question: can the U.S. president convince the world to stop buying Russian energy.

Last week, Trump imposed sanctions on Russia’s two largest oil companies—Rosneft and Lukoil—in an effort to limit Moscow’s ability to fund its war. According to The Guardian, the move represents the most sweeping sanctions decision since the start of the full-scale invasion.

Tom Keatinge, founder of the Centre for Financial Crime and Security Studies at the defense think tank RUSI, said, “The U.S. has done more in 24 hours than the EU has in the past six months.” Trump, he added, is willing to say what others consider too bold or diplomatically inconvenient. “For a long time, many have urged him to wield the sanctions hammer—and this could make a real difference.”

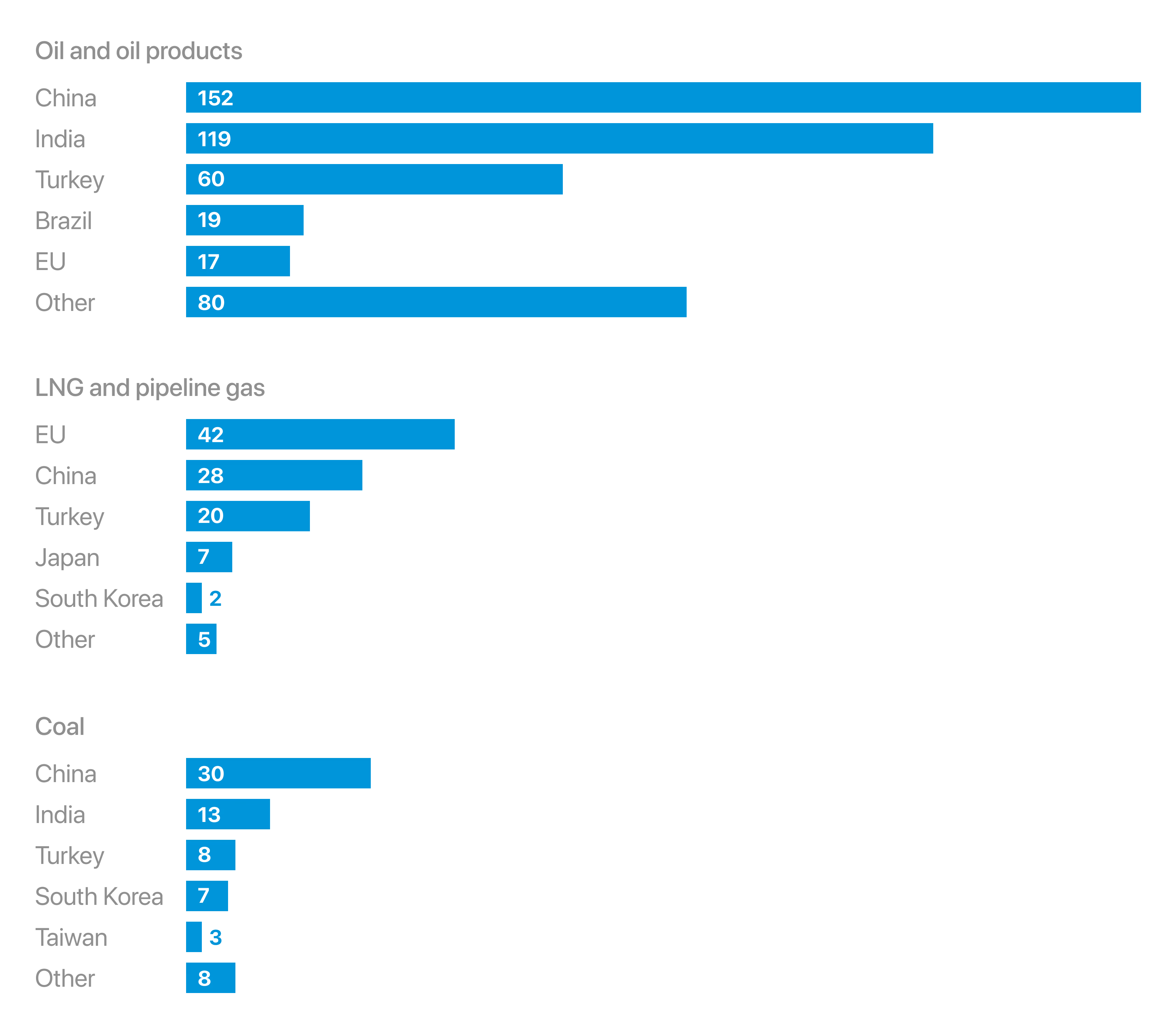

Fossil Fuel Export Revenues from February 24, 2022 to End-September 2025, € Billion

Now, companies buying Russian oil risk losing access to the dollar-based financial system. As The Guardian writes, this is particularly significant for India and China, which—since Russia’s invasion of Ukraine more than three and a half years ago—have become the largest importers of Russian oil and gas.

Markets React Instantly: Asia Cuts Purchases as the Kremlin Loses Billions

The effect was immediate. Within hours of the sanctions being announced, global oil prices rose by 6%, while major Indian refineries and China’s state-owned oil companies suspended purchases of Russian crude.

Indian Refineries Prepare to Nearly Halt Purchases of Russian Oil After U.S. Sanctions on Rosneft and Lukoil

State and Private Plants Seek Ways to Avoid American Secondary Restrictions

Starmer Vows to Eliminate Russian Oil and Gas from Global Markets

Leaders of the U.S., U.K., and Ukraine Step Up Pressure on Putin After Sanctions on Rosneft and Lukoil

According to Luke Weekenden, an analyst at the Centre for Research on Energy and Clean Air (CREA), a sharp drop in fossil fuel imports from Asia would be “devastating” for the Kremlin’s export revenues. The Guardian notes that such a collapse in exports could wipe out billions of dollars in Russia’s monthly earnings.

“From January to September this year, 86% of Russian oil exports—including pipeline deliveries—went to China and India. If Moscow loses access to these markets, it could forfeit roughly $7.4 billion in monthly revenue, equivalent to about $3.6 billion in tax income flowing directly into the Kremlin’s war budget,” Weekenden said.

“There are, however, signs of hope. In September, imports of Russian crude by India’s state-owned refineries fell to their lowest level since May 2022—down 38% from the previous month. If India alone were to scale back its purchases, the Kremlin would lose about $1.6 billion in monthly tax revenue,” The Guardian quoted him as saying.

Russia’s fossil fuel export revenues fell by 4% last month, hitting their lowest point since the start of the full-scale invasion—just half the level recorded in September 2022. Yet, as The Guardian notes, Moscow continues to evade restrictions by using a “shadow fleet” of aging tankers.

Despite the decline, revenues are still sustained by oil and gas sales to buyers in Asia and Eastern Europe, as well as seaborne LNG shipments to the EU. Moreover, Russia reportedly continues to move millions of tons of crude through so-called “shadow tankers”—an aging fleet used to bypass Western sanctions.

Trump’s latest measures to deprive Putin of energy revenues followed a lukewarm response to his calls for India and China to cut Russian fuel imports under threat of worsening trade terms. As The Guardian reports, the cautious reactions from Beijing and New Delhi underscore the limits of U.S. influence over Asian economies.

China condemned what it called “unilateral pressure” and “economic coercion” from the Trump administration, insisting that its purchases of Russian oil are “legitimate” and vowing “resolute countermeasures” should its national interests be harmed.

Trump, meanwhile, said that Indian Prime Minister Narendra Modi assured him in a phone call this week that New Delhi “won’t be buying much oil from Russia” because it also “wants to see the war between Russia and Ukraine end.” Modi confirmed the conversation—during which Trump congratulated him on Diwali—but did not publicly commit to reducing Russian imports.

Trump’s Energy Policy Opens New Opportunities for the U.S. in Europe

According to Tom Keatinge, Trump’s campaign to curb Russia’s energy influence offers a dual advantage. “There’s an opportunity here to bring peace to Ukraine—and profit to the United States,” he told The Guardian.

The United States has become Europe’s largest supplier of liquefied natural gas after the war in Ukraine effectively halted Russian pipeline flows and slowed maritime shipments. As The Guardian notes, last year the U.S. accounted for more than 55% of the EU’s LNG imports—whereas in 2019 the figure was almost zero.

Following the EU’s decision to phase out all imports of Russian gas—including LNG—by early 2027, Trump may expect a surge in U.S. gas exports to Europe. Despite Europe’s sharp reduction in dependence on Russian energy, the continent continues to fund the Kremlin through purchases of Russian oil and gas—what Keatinge calls “a shameful stain on the EU’s reputation.”

According to CREA, the EU remains the largest buyer of Russian LNG, accounting for half of all Russian exports, followed by China (22%) and Japan (18%). The bloc also leads in pipeline gas purchases—35% of total Russian exports—trailing China (30%) and Turkey (29%).

"Helping to Weaken Russia"

The More Russian Gas France Buys, the Louder Its Promises Not to Let Moscow Prevail in Ukraine

Paris Remains the EU’s Largest Importer of Russian LNG Despite Calls for an Embargo

Court in The Hague Lifts Freeze on Gazprom’s Assets in the Netherlands

Ukrainian Claims Rejected Over 'Sovereign Immunity' Principle

Last month, Hungary and Slovakia were the EU’s top importers of Russian gas, purchasing fossil fuels worth €393 million and €207 million, respectively. As The Guardian reports, Russian gas continues to reach France, Belgium, and the Netherlands despite public pledges to abandon it.

France ranked third among EU importers last year, buying €153 million worth of Russian gas—entirely in the form of LNG, part of which was later re-exported to Germany. Belgium was fourth, importing €92 million of Russian LNG, while the Netherlands purchased €62 million.

“The EU is rushing to declare it will end imports by January 2027,” said Keatinge. “But how many Ukrainians will die before then? Some European countries managed to cut off Russian supplies almost immediately—this decision should have been made three years ago. Of course, we must demand accountability from India and China, but no less from ourselves,” The Guardian quoted him as saying.

The long-term consequences of Trump’s energy offensive against Russia—and whether it will bring peace to Europe and benefit the U.S.—remain uncertain. Experts cited by The Guardian warn that much will depend on how strictly the sanctions are enforced and how countries still reliant on Russian energy respond.

Still, Keatinge remains optimistic. “Never bet against Trump,” he added.