The U.S. Senate and House of Representatives have officially approved a sweeping tax and budget bill, informally dubbed the One Big Beautiful Bill Act. Despite internal disagreements, Republicans succeeded in pushing the initiative through both chambers of Congress, where they hold a majority. This marks a significant domestic political victory for Donald Trump, who plans to sign the bill into law on July 4—Independence Day—amid celebratory festivities.

The bill includes major tax cuts, primarily benefiting high-income earners, as well as deep reductions in social welfare programs, including healthcare coverage and food assistance. Opponents—primarily Democrats—warn of potential long-term consequences: the legislation is expected to significantly increase the federal deficit, which is already approaching the size of the country’s annual GDP, and could complicate budget decisions for future administrations.

Only a few Republicans voted against the bill despite widespread criticism. Democrats have called it "the greatest betrayal" of the country’s most vulnerable citizens, but with the current balance of power in Congress, they were unable to alter the outcome.

Why Was the One Big Beautiful Bill Act Introduced?

At the heart of the new bill lies a permanent extension of the tax breaks first introduced in 2018 under the Tax Cuts and Jobs Act. These measures, initiated during Donald Trump's first presidential term, were originally set to expire in 2025. Without an extension, voters would have faced a noticeable tax hike—an outcome clearly at odds with Trump's campaign strategy. As a result, the status quo is preserved for households and businesses. But the cumulative cost of this generosity is now projected to reach $4.5 trillion by 2034.

The key provisions are as follows: the top individual income tax rate will remain at 37%, even though it would have otherwise reverted to 39.6% for incomes above $626,400 per year. The corporate tax rate stays at 21%, rather than returning to the previous 35%. A promised cut to 15% for manufacturing firms, despite repeated pledges from Trump, has not materialized.

For owners of so-called pass-through businesses—from sole proprietors to LLCs and partnerships—the tax deduction introduced in 2018 will rise from 20% to 23%. The threshold for estate tax exemption will increase to $15 million.

Significant changes have also been made to state and local tax (SALT) deductions: the cap introduced in 2018 has been raised from $10,000 to $40,000 per year through the end of 2028. This measure primarily benefits wealthy taxpayers in high-cost states like California and New York.

By the end of Trump’s second term, new deductions will also take effect, framed as campaign promises fulfilled: up to $25,000 for tip-based income, $12,500 for overtime pay, and an additional $6,000 for retirees.

Finally, the child-related tax break remains in place. The Child Tax Credit rises from $2,000 to $2,500 per child, though—like several other provisions in the bill—this increase is set to expire at the end of 2028.

Tariff Policy of Trump

Who Invented Trump’s Tariff Policy That Shook Global Markets?

Meet Peter Navarro

Trump Threatens 200% Tariffs on Imported Drugs and Copper

Backed by Economic Growth, the White House Doubles Down on Aggressive Protectionism

The U.S. Is Losing Investor Confidence—But the Dollar Remains Irreplaceable

Trump’s Policies Undermine the Foundations of the Global Financial Order, Yet the Dollar Still Has No Real Rivals

When Protectionism Backfires on the US

Why German Businesses Are Pulling Back Investment and Losing Faith in the American Market

Why Does Trump Need the One Big Beautiful Bill Act?

The bill allocates generous funding for Donald Trump’s top priorities in immigration and domestic policy. It sets aside $45 billion to expand the deportation system—money that will be used to build new detention centers for undocumented migrants. Another $46.6 billion is earmarked for the construction of a wall on the U.S.-Mexico border, a project Trump first promised in 2016 and which now receives three times more funding than during his first term. Altogether, spending on homeland security and efforts to curb illegal immigration will increase by more than $300 billion.

Donald Trump signs the One Big Beautiful Bill Act. July 4, 2025.

Other measures include a tax hit on the nation’s wealthiest private universities. As part of a campaign against academic elites, the bill raises the tax on university endowments from 1.4% to 8%. The original House version proposed an even steeper hike—to 21%. The new rate will primarily affect institutions such as Harvard, Yale, Princeton, Stanford, and other top-tier universities with large endowment funds.

The bill also features a provision seen as symbolic by supporters of the Second Amendment. For the first time since 1934, it eliminates the $200 tax formerly required for the purchase of short-barreled rifles, shotguns, and suppressors. For the gun rights movement, this is viewed as a major victory.

Why Is the One Big Beautiful Bill Act Being Criticized?

The extension of tax breaks and the surge in government spending—from military programs to immigration enforcement—will be paid for by cutting aid to those who need it most. The plan aims to save around $1.5 trillion by reducing funding for Medicaid, SNAP food assistance, and other social support programs, including stricter rules for student loans.

Today, Medicaid provides insurance coverage to roughly 72 million people—nearly one-fifth of the U.S. population. It funds nursing home care, covers more than 40% of all births nationwide, and nearly half of all births in rural America, a region where Trump’s electoral base is particularly strong. According to projections, implementation of the new bill could leave between 12 and 17 million Americans without coverage by 2034. "What am I supposed to tell my 663,000 constituents when Trump takes away their Medicaid in two or three years?" asked Republican Senator Thom Tillis of North Carolina from the Senate floor—one of the few in his party to vote against the president’s initiative.

The result will be deeper inequality: according to Yale University experts, the real income of the poorest 20% of Americans will fall by 2.9%—an average of $700 per year. Meanwhile, those in the top 1% will see their income rise by about 1.9%, or roughly $30,000 annually. This outcome is a direct result of pairing tax cuts with reduced spending on social programs.

Even such sweeping cuts are not enough to fully offset the cost of the legislation. Preliminary estimates suggest the federal debt will increase by $3.3 trillion over the next decade. And if the temporary tax breaks on tips and overtime—set to last through the end of Trump’s second term—are extended by his successor, total debt growth could exceed $5 trillion by 2034.

What About the Federal Debt?

The passage of the new bill adds further pressure to an already alarming debt trajectory. By 2024, U.S. federal debt had reached 98% of GDP—and even without Trump’s proposed spending, it was projected to climb to 156% by 2055. With the new law, the forecast is even more severe: within three decades, the debt could exceed 200% of GDP—twice the size of the entire U.S. economy. For comparison, the previous record debt level was 106% of GDP, reached in 1946 in the aftermath of World War II.

The international credit rating agency Moody’s has already responded to the deteriorating fiscal outlook. Among the reasons cited for downgrading the U.S. credit rating from the top-tier "Aaa" to "Aa1" was the passage of legislation expected to accelerate debt growth.

Despite the resilience of the U.S. economy, fiscal recklessness raises the risk of a full-blown debt crisis. The logic is straightforward: creditors who lend to the federal government begin to question the reliability of U.S. borrowing. To restore confidence, the Treasury will have to raise bond yields—in other words, offer investors higher interest rates. That would drive up borrowing costs across the economy, from mortgages to consumer loans, inevitably squeezing household budgets and slowing economic growth.

In essence, Trump’s bill postpones the inevitable—a tough reckoning that will require both spending cuts and tax increases. But that responsibility will likely fall to future presidents.

Trump-Pump-Pump

A Trade War With China That Is Nearly Impossible to Win

The U.S. Is Confronting the Consequences of Its Own Strategy

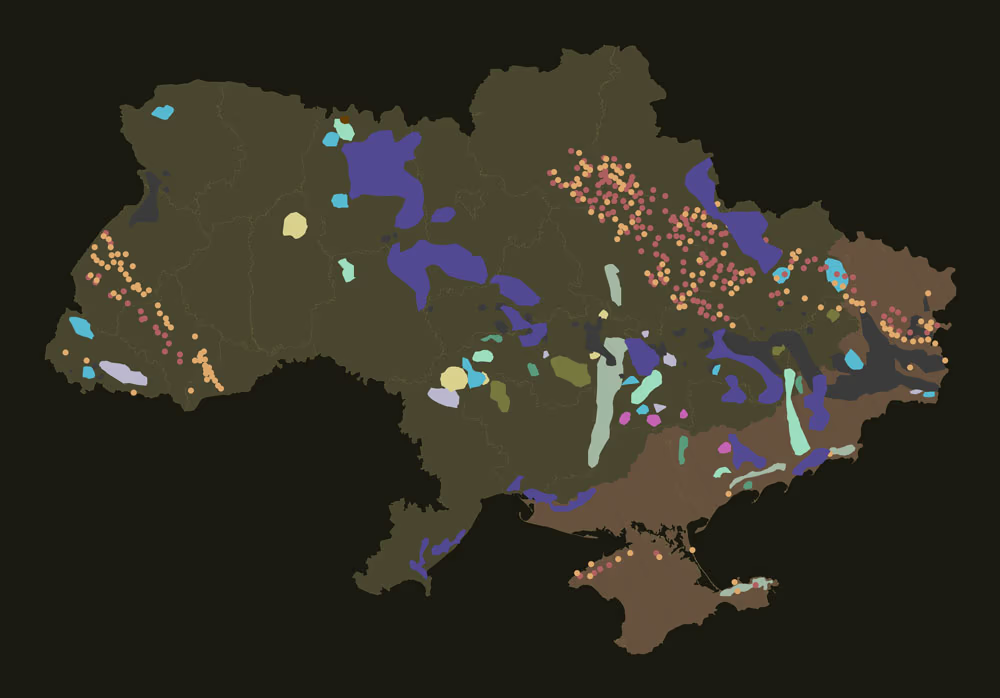

Trump Plans to Take All of Ukraine’s Natural Resources

What Is Happening at the Deposits Under Ukraine’s Control That the U.S. Wants to Manage?

He Did It

Trump Sends U.S. Trade Policy Back to the 19th Century with a Ridiculous Justification for Extreme Tariffs

Why Is Elon Musk Unhappy?

While Elon Musk did publicly criticize the scale of spending and the increase in national debt embedded in Trump’s bill, his falling out with the former president is not rooted in fiscal disagreements. The real source of tension is green energy. The new legislation effectively dismantles subsidies introduced under the Inflation Reduction Act, a cornerstone of Joe Biden’s climate agenda. Those measures had provided critical financial support for companies like Tesla operating in the clean tech sector.

Trump did not let it slide. In one of his posts, he claimed that without government subsidies, Musk would have to "shut it down and go back to South Africa," and—true to form—threatened to "sic DOGE" on his business.

Under the provisions of the bill, tax incentives will remain in place only for projects commissioned before the end of 2027. At the same time, stricter restrictions on the use of Chinese components will be introduced. Taken together, these changes are expected to raise the cost of new energy projects by 10–20% and increase total industry spending by $4–7 billion over the next decade.

According to estimates by the nonprofit organizations Rhodium and Energy Innovation, the U.S. could lose up to 830,000 jobs in the green energy sector by 2030. That figure includes both the shutdown of existing projects and the cancellation of new ones that could have added about 500 gigawatts of capacity—more than 40% of the country’s entire power system.

One of the immediate consequences could be a rise in electricity prices. The increase is expected to hit hardest in Republican-led states that have seen rapid growth in wind and solar generation in recent years. According to Energy Innovation, prices in Kansas, Montana, Kentucky, Oklahoma, Texas, and North Carolina could rise by 14–18%. In Texas, nearly all of the state’s added energy capacity over the past decade has come from renewables. But even there, the negative effects are likely to materialize only under the next administration.