The surge in US natural-gas prices is accelerating amid record fuel exports, deepening concerns about domestic energy affordability and creating political liabilities for Donald Trump.

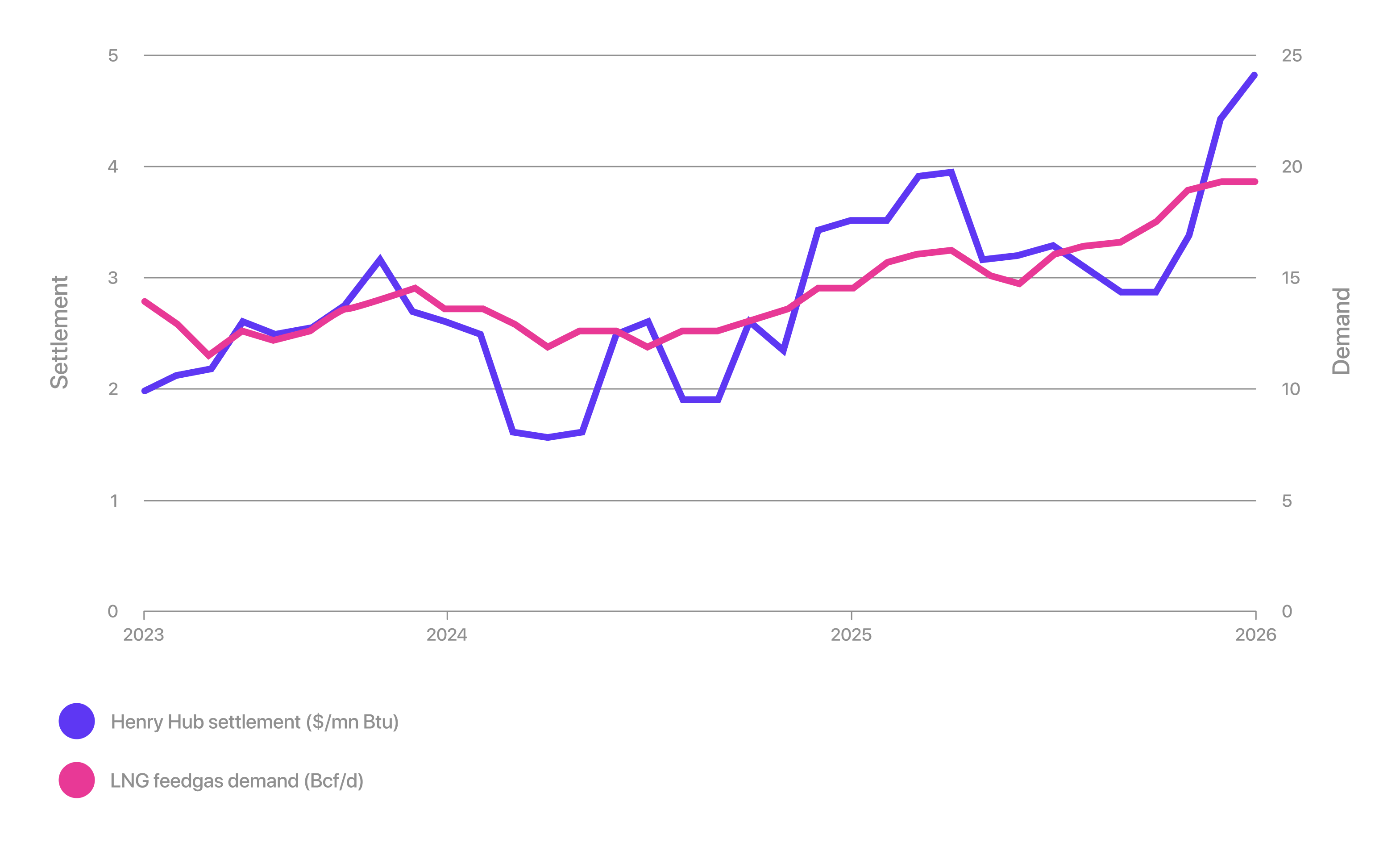

Wholesale prices have climbed more than 70 percent over the past twelve months, and the Henry Hub benchmark reached $5.29 on Friday—the highest level since December 21, 2022, when Russia’s full-scale invasion of Ukraine destabilised global energy markets.

The spike reinforces the perception of rapidly rising costs and undercuts Trump’s claims that energy prices have fallen during his first year back in power. The situation is further strained by a sharp nationwide cold snap, which has driven up electricity demand for heating homes and businesses.

Trump has bet on expanding LNG exports and boosting domestic gas production, framing both as pillars of his push for US “energy dominance” and a way to fuel the artificial-intelligence boom. But discontent is building among households and businesses, who argue that rising rates are intensifying the “cost-of-living crisis” and eroding competitiveness.

“As North America exports more natural gas, it is effectively importing higher and more volatile prices,” said Clark Williams-Derry, an analyst at the Institute for Energy Economics and Financial Analysis, which is funded by environmental foundations. “That’s great news for the gas industry, whose revenues have surged. But if you are a US consumer relying on gas for heating or electricity, the picture looks far less reassuring.”

Analysts say the trend may mark a structural shift in price formation: an ever-larger share of production is being diverted to the fast-growing LNG export market, while demand from energy-hungry data centres powered by artificial-intelligence technologies is set to rise. “On the coldest winter days, LNG exporters and local consumers are competing for the same molecules of fuel. In extreme weather, there may not be enough gas to satisfy both,” explained Eric McGuire, an analyst at the consultancy Wood Mackenzie.

The Industrial Energy Consumers of America, a coalition of major manufacturing companies, has argued that US authorities should prioritise domestic users over LNG exports. “As export volumes rise, so do price risks and supply-reliability risks for American consumers, which directly affects the competitiveness of industry,” said Paul Cicio, the group’s executive director. “We have no alternative. We’re stuck at the end of the pipeline.”

Natural-gas Prices Are Climbing Amid Rising LNG Exports

A Yahoo/YouGov poll published last week found that, by a two-to-one margin, respondents believe Trump has driven prices up (49 percent) rather than down (24 percent). This week, the president dismissed concerns about living costs as “a fraud cooked up by Democrats.”

During last year’s campaign Trump pledged to halve energy costs within twelve months—a message that resonated with voters worn down by high inflation and rising utility bills under the Biden administration. Yet since his return to office, electricity and piped-gas bills have continued to climb: in September, tariffs rose 5.1 percent and 11.7 percent respectively compared with the same month a year earlier, according to data from the US Bureau of Labor Statistics.

According to the US Energy Information Administration—the government’s statistical agency—the average price of natural gas purchased by power plants is set to rise 37 percent this year, while industrial users can expect a 21 percent increase compared with 2024 averages. For residential and commercial consumers, the agency projects an annual increase in bills of roughly 4 percent.

In September, US LNG exports reached a record 9.41mn tonnes, nearly 20 percent higher than in the same month a year earlier, the EIA notes. American LNG has become a critical supply source for Europe amid its most severe energy crisis in decades, as the continent rushed to wean itself off Russian fuel following Moscow’s full-scale invasion of Ukraine. The main destinations included Spain, France, the United Kingdom and the Netherlands.

Representatives of the LNG industry and gas producers insist that rising exports are not to blame for higher energy costs for end users, arguing that the US is not short of gas to extract. Instead, they say, the problem stems from policymakers’ failure to enable the construction of new pipelines and storage facilities needed to serve major markets. “This isn’t about AI or LNG exports. It’s much simpler. Political decision-making has overridden market forces, and that shows up in the blocking of pipelines and energy infrastructure,” said Toby Rice, head of EQT, the country’s largest gas producer.

According to EQT, insufficient infrastructure has left US markets increasingly fragmented. The company expects to sell gas in the Appalachians this winter for about $4 per million British thermal units, while prices in Boston and parts of New England will approach $14 for the same amount because of severely constrained pipeline capacity. “This isn’t just the most expensive natural gas in the country—it’s the most expensive natural gas in the world,” Rice said.

Analysts, however, argue that the rapid expansion of LNG supply, growing demand from data centres and rising production costs at fields such as Haynesville will continue to exert significant upward pressure on prices. “Between now and 2030, LNG export capacity on the Gulf Coast will double from today’s levels—and that will inevitably feed into pricing,” said Mathieu Atting, an analyst at Rystad.