Washington has drafted an agreement granting American companies priority rights to develop Ukraine’s mineral deposits. Previously, there had been discussions about Kyiv opening access to its rare earth metal reserves—strategically important resources for high-tech industries—as a form of compensation for U.S. military assistance. The agreement was scheduled to be signed at the end of February during a meeting between Presidents Donald Trump and Volodymyr Zelensky at the White House. However, the talks ended in scandal: a public verbal clash between the leaders led the Ukrainian delegation to walk out without signing the document.

By the end of March, the media obtained an updated version of the U.S.-Ukraine agreement, significantly broader in scope than the previous draft. It now covers not only rare earth metals, but all of Ukraine’s natural resources—including coal, oil, and natural gas. Moreover, the document grants the U.S. authority over investment oversight in critical infrastructure related to the extraction and processing of these resources. This includes road and rail networks, seaports, mines, as well as industrial and processing facilities.

According to data published by The Washington Post shortly after the start of the full-scale war, Russia has taken control of territories containing significant portions of Ukraine’s natural resources. These include 63% of coal reserves, 11% of oil, 20% of natural gas, 42% of metals, and 33% of rare earth and other strategically important elements.

Ukrainian authorities have so far refrained from making strong statements regarding the proposed agreement with the U.S., limiting themselves to the phrase "ongoing negotiations." Meanwhile, the document has raised serious concerns within the expert community. Analysts warn that the proposed terms could hinder the country’s European integration process and cast doubt on its economic sovereignty. One Ukrainian official, speaking to the Financial Times on condition of anonymity, called Washington’s initiative "a looting operation." And The Times described the draft as “another humiliation” for Kyiv, expressing doubts about the document’s viability amid ongoing hostilities and the loss of control over a significant part of the country’s territory.

Ukraine’s Mineral Resources

Graphite in Kirovohrad Region

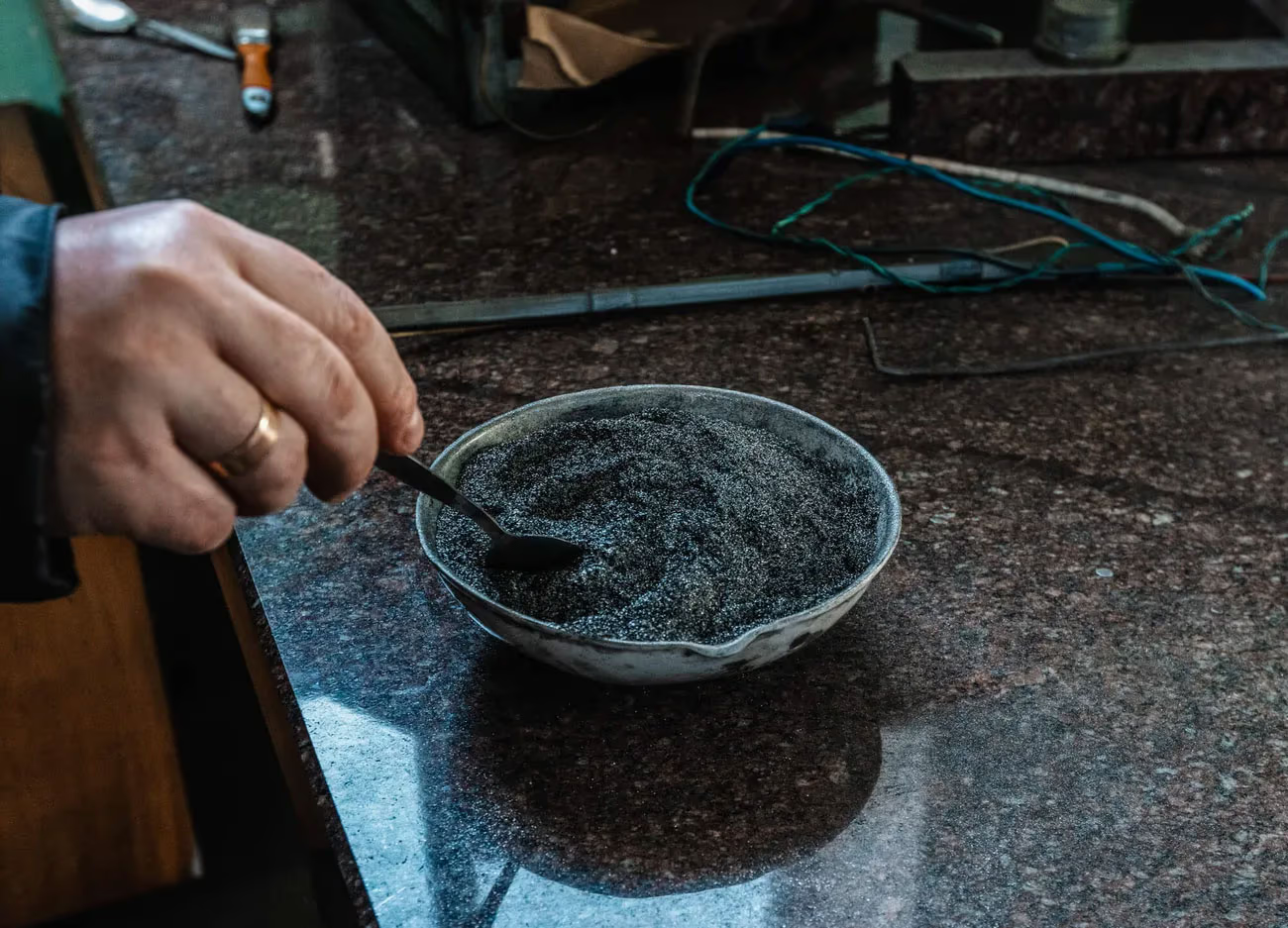

Ukraine’s only natural graphite mining enterprise—Zavalievsky Graphite—was located in the Kirovohrad region. However, it suspended operations in December 2024. According to the National Association of Mining Industries of Ukraine, the suspension was caused by a sharp increase in energy and logistics costs, as well as a drop in global graphite prices. The association emphasized that the closure threatens the country’s domestic supply of this strategically important material, and Ukraine will now have to seek alternative sources abroad.

Graphite extraction at the Zavalievsky deposit—the largest in Europe. Kirovohrad region, February 28, 2025.

Zavalievsky deposit, Kirovohrad region, February 28, 2025.

Graphite has been mined at the Zavalievsky deposit since 1934. Extraction is carried out via open-pit mining.

Graphite is used in the chemical industry, metallurgy, mechanical engineering, electrical manufacturing, and other fields, including the production of pencils and heat-resistant rubber.

According to the company’s website, Zavalievsky graphite “has an almost perfect crystalline structure and contains a minimal amount of impurities, which can be easily removed from the ore.”

Titanium in Zhytomyr Region

The Zhytomyr region is home to the largest apatite-titanium deposit in Europe—the Semigorodske deposit. Ukraine is one of only seven countries in the world with the technology to produce titanium sponge—the primary raw material for titanium metal. This was reported by the American publication Newsweek in January 2023 in an article titled "The Battle for Ukraine’s Titanium." The article emphasized that the U.S., heavily reliant on imported titanium, finds itself in a vulnerable position: the largest supplier is China, while Russia controls around 13% of the global market. Under these conditions, access to Ukrainian deposits becomes strategically important for both Washington and Moscow. According to Newsweek’s authors, if Ukraine wins the war, the U.S. and its allies could gain a new, reliable source of titanium. Conversely, if control over the deposits shifts to Russia, the Kremlin would strengthen its influence over the global market for this increasingly in-demand resource.

Titanium is widely used in the production of civilian and military equipment, as well as in other industries. Titanium mining in Zhytomyr region. February 28, 2025.

The company structures of Dmytro Firtash also owned the "Crimean Titan" plant. After Russia’s annexation of the peninsula, the facility became known as "Russian Titan." According to estimates by The Washington Post, Ukraine has lost access to two titanium deposits in total. Pictured: titanium deposit in Zhytomyr region.

In 2021, Ukrainian ilmenite (one of the main titanium-bearing ores) accounted for about 5% of global production of all ores used for titanium manufacturing. In 2022, when Russia launched its full-scale invasion of Ukraine, ilmenite exports from the country dropped by more than 40%. Zhytomyr region.

Titanium mining in Zhytomyr region was carried out by Group DF, owned by Ukrainian businessman Dmytro Firtash. In 2021, Firtash came under Ukrainian sanctions, and in 2023, Group DF had its license to use mineral resources revoked due to being linked to a sanctioned individual. Group DF managed to challenge the decision, but its key facility—the Mezhyrichensky Mining and Processing Plant—remained idle for nearly a year.

Coal in Donetsk Region

According to Forbes, as reported in April 2023, the total value of all Ukraine’s natural resources is estimated at around $14.8 trillion. Of this amount, over $9.1 trillion comes from hard coal reserves, with an additional $261 billion attributed to lignite deposits. However, a significant portion of these resources is beyond the control of the Ukrainian government. As The Washington Post noted in August 2022, about 63% of the country’s coal reserves are located in the east—primarily in Donetsk and Luhansk regions, which are under Russian control. The only major coal basin remaining under Kyiv’s control is the Western Donbas, located in Dnipropetrovsk region. Thus, despite the enormous valuation of Ukraine’s resource wealth, the real potential for development and use depends on the course of the war and the restoration of control over key regions.

During the war, Pavlogradvuhillia allocated part of its dormitories to house Ukrainians forced to flee their homes due to the fighting. Pictured: Heroiv Kosmosu Mine, March 4, 2025.

Heroiv Kosmosu Mine.

Heroiv Kosmosu Mine, part of Pavlogradvuhillia.

The Western Donbas basin is home to Ukraine’s largest coal mining company—DTEK Pavlogradvuhillia.

Trump-Pump-Pump

No Security Guarantees, but Access to Resources

The U.S.-Ukraine Minerals Deal Turns Support Into a Transaction—Both Sides Are Betting on Long-Term Gains