For decades, globalization seemed like an unstoppable force: it lowered prices, connected markets, and erased borders not with tanks, but with trade routes. Today, more and more voices are declaring: that era has come to an end.

Last week, the UK’s Chief Secretary to the Treasury, Darren Jones, said on BBC Sunday Politics that "globalization as we’ve known it for the past few decades is over." His comments came amid the backdrop of new tariffs introduced by Donald Trump’s administration and a growing sense that the world is shifting toward a more fragmented and protectionist economic model. When asked whether the era of cheap fast fashion and low-cost electronics was finished, he responded simply: "Yes, it is."

"Globalization is over. The era of globalization was a historical anomaly... It was the United States that ensured the security of global trade. That enabled global finance and manufacturing. And now—it’s all over."

Darren Jones, Chief Secretary to the Treasury, UK, April 6, 2025, BBC

Darren Jones, Chief Secretary to the Treasury, UK, April 6, 2025, BBC

It’s a stark claim—but not without merit. After World War II, the United States assumed an informal yet vital role as the guarantor of global order: its navy patrolled sea lanes, allowing countries to trade without needing their own military escorts. This created the foundation on which the just-in-time model and sprawling international supply chains could thrive.

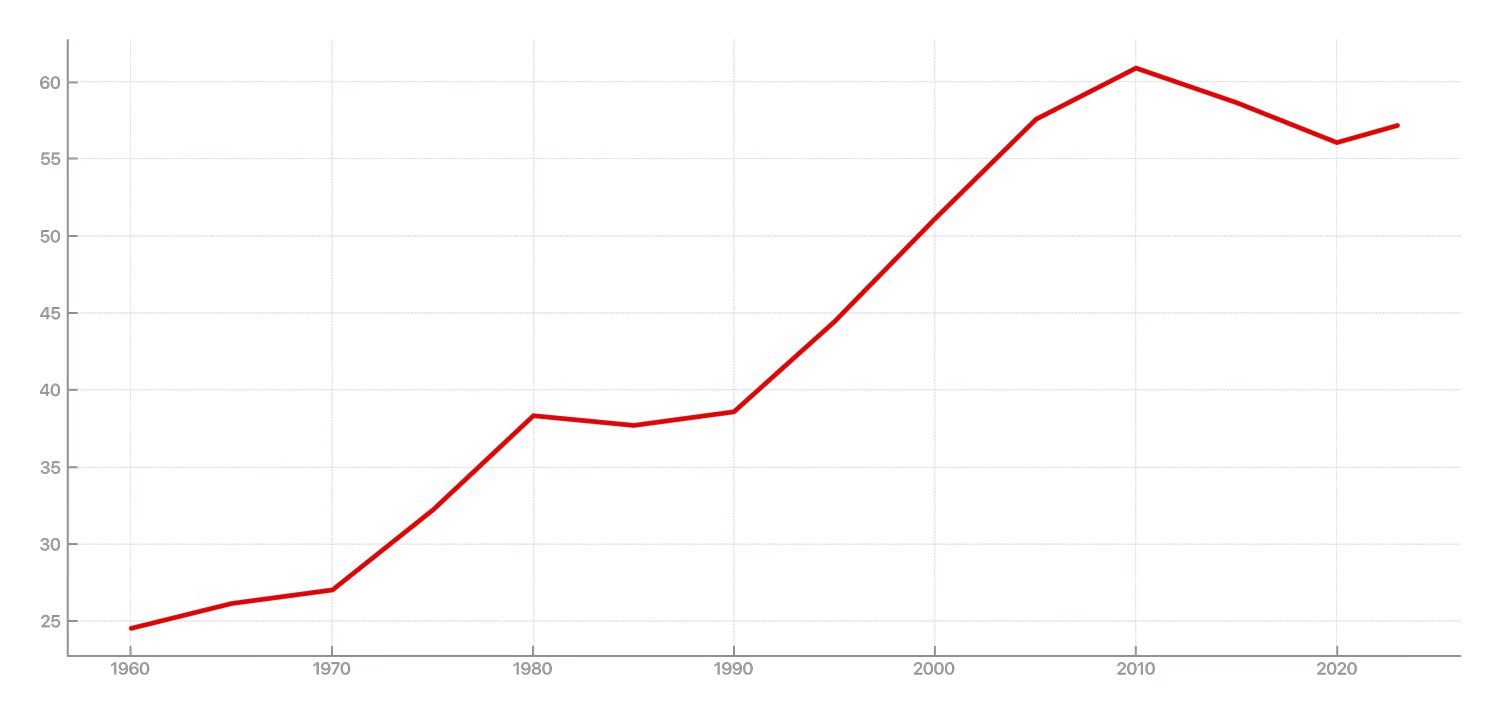

Share of Global Trade in World GDP (1960–2023), %

But today, that geopolitical consensus is unraveling. Trade wars driven by national self-interest, the COVID-19 pandemic exposing supply chain vulnerabilities, the war in Ukraine, and the deterioration of U.S.-China relations all signal a rapid departure from the old global order.

The impact of these trade wars has already hit financial markets. Following Trump’s announcement of sweeping tariffs, the Russell 3000 index fell by 5%, and after China's retaliatory measures, it dropped another 6%. JPMorgan Chase now estimates a 60% chance of a global recession this year. Over the past week, cyclical stocks (airlines, automakers) have significantly underperformed defensive stocks (consumer staples, utilities), in line with a soft global recession scenario.

The effects of the trade war are being felt beyond the U.S. The MSCI World Index, which covers 85% of the market capitalization of developed countries, has declined almost as much as U.S. indices. Earnings expectations for European companies have fallen by 1.5%—mirroring the drop in U.S. corporate earnings forecasts.

Not everyone shares this pessimistic outlook, however. World Bank economist Marcos Troyo argues: "Globalization isn’t dying—it’s shifting into a digital form, where digital platforms and virtual markets replace physical supply chains." History suggests globalization is cyclical. In the early 20th century, the world experienced a period of unprecedented trade growth and international cooperation, which came to a halt with World War I and the Great Depression.

Darren Jones noted that negotiations with the U.S. are ongoing, and a tariff agreement is still possible. But for consumers and companies, the reality is already shifting: cheap goods that once seemed routine are becoming the exception. The new economic order, it appears, will be more expensive—and more complex.

World Trade Organization Director-General Ngozi Okonjo-Iweala recently warned: "A world where everyone only protects their own interests—that’s a path to poverty."

One positive factor is that the global economy remains in relatively good shape. The composite index of global economic growth showed improvement in March, particularly in the services sector, which has so far remained unaffected by tariffs. Unemployment across OECD countries is still below 5%. The U.S. economy added 228,000 new jobs last month, and current growth is tracking above 2% annually. While Donald Trump may have committed one of the greatest political miscalculations of all time, he was fortunate to inherit a strong economy. The question is—how long will that resilience last?

Economy Without a Manual

The U.S. Economy as a Source of Global Instability

American Policymaking Increasingly Resembles That of Emerging Markets

The U.S. Is Losing Investor Confidence—But the Dollar Remains Irreplaceable

Trump’s Policies Undermine the Foundations of the Global Financial Order, Yet the Dollar Still Has No Real Rivals

The Real Economy Is Out of Sight

Without Rethinking Data on Supply Chains, Digital Services, and Vulnerabilities, Decisions Are Made Blindly

An Economy Where No One Pays Now

Global Debt Is Growing Faster Than the Ability to Service It

When Protectionism Backfires on the US

Why German Businesses Are Pulling Back Investment and Losing Faith in the American Market