Tesla’s car sales fell for a second consecutive year, dropping in 2025 to their lowest level since 2022. Over the full year, China’s BYD overtook Tesla in global electric-vehicle sales for the first time: 2.26m vehicles for BYD versus 1.64m for Tesla.

The sales trajectory is strategically critical for the company, as its automotive business remains the primary source of funding for Elon Musk’s ambitions in artificial intelligence, including humanoid robots and autonomous vehicles. On Friday, Tesla reported an 8.6% year-on-year decline in deliveries—a metric closely aligned with actual sales—to 1.64m vehicles.

The annual decline came despite an unexpected surge in demand in the third quarter, when buyers rushed to purchase electric vehicles before a federal tax credit expired at the end of September. Since reaching a historic peak in 2023, deliveries have already fallen by 9.5%.

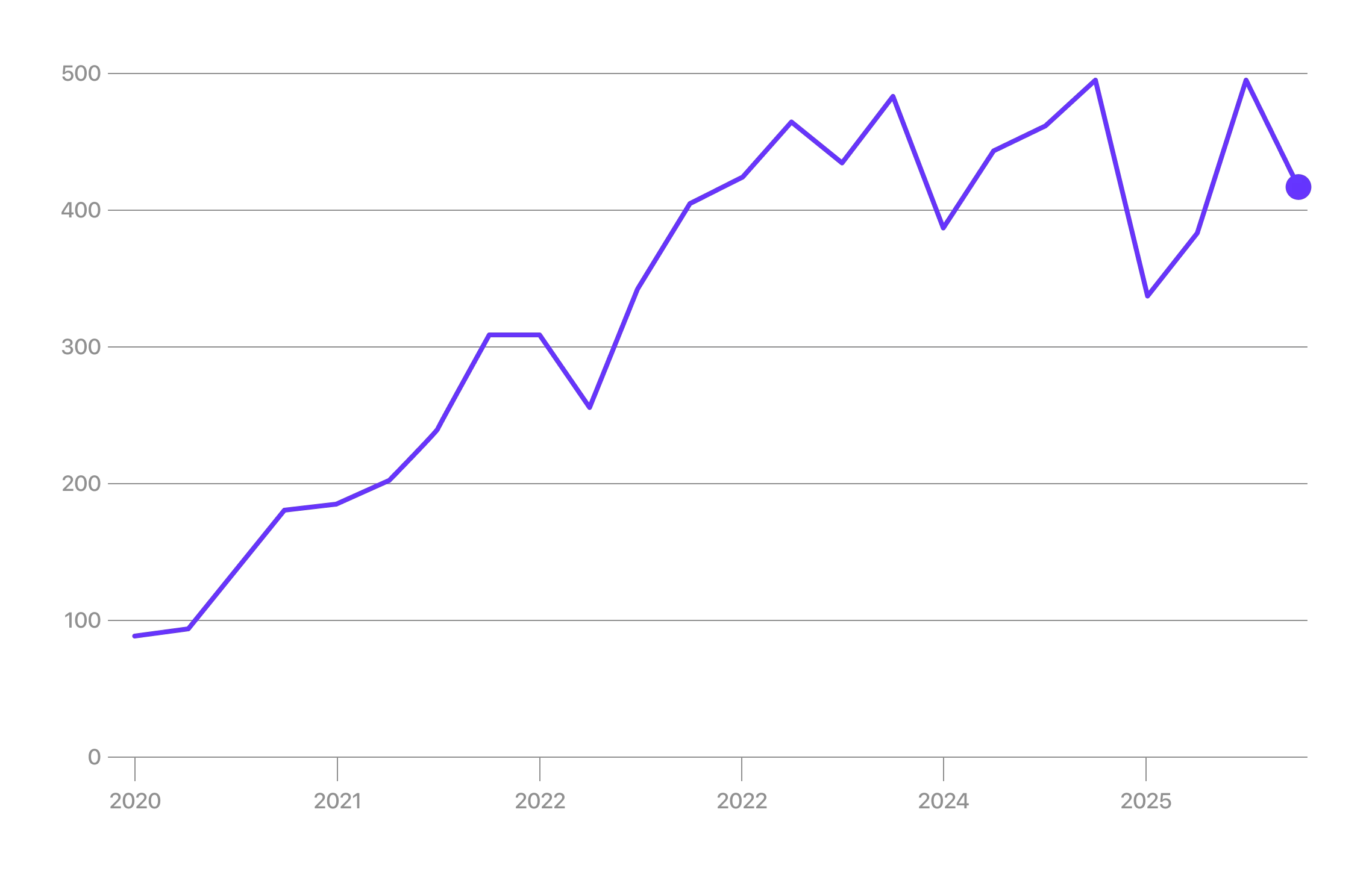

In the fourth quarter, Tesla delivered 418,227 vehicles—15.6% fewer than a year earlier and below Wall Street’s consensus forecast of 422,900 units. It was also the company’s weakest fourth-quarter result since 2022.

Tesla Quarterly Vehicle Deliveries, Number of Vehicles Delivered per Quarter (Thousands)

In a broader context, the decline in sales was driven by a combination of political factors and regulatory changes. In early 2025, the company faced a backlash over Elon Musk’s political activity, while in the second half of the year an additional blow came from the expiration of the federal tax credit for electric vehicles.

Some potential buyers turned away from Tesla after Musk became a close adviser to President Trump and took charge of the DOGE team tasked with cutting federal spending. Musk himself acknowledged that his political involvement had triggered “a certain negative reaction” that hurt the business, and he later left the administration. Alongside this, there is a non-political source of pressure on sales: Tesla’s product lineup has visibly aged.

The exterior design of the company’s core models has remained largely unchanged since their market debut, while the only new vehicle introduced in recent years has been the niche Cybertruck. At the same time, as Dan Ives, a technology-sector analyst at Wedbush Securities, noted, sales results were “significantly better than whisper expectations,” which had been around 410,000 vehicles in the fourth quarter. So-called whisper numbers refer to informal estimates that often more accurately capture analysts’ true expectations. Following the report, Tesla shares rose 0.7% in early Friday trading.

Attention remains focused on whether Tesla’s autonomous-transport strategy can deliver results in 2026. The company recently launched a self-driving vehicle service in Austin, Texas, and expects to scale it up significantly over the course of the current year.