American investor and author of Rich Dad, Poor Dad Robert Kiyosaki has once again issued a dire warning. In a recent post on X, he declared that "the end" has already begun: according to him, the Federal Reserve allegedly failed to sell U.S. government bonds and was forced to buy $50 billion worth itself—an event he claims signals the onset of hyperinflation and financial collapse. "The party is over," he concludes, predicting gold will soar to $25,000, silver to $70, and Bitcoin to $500,000—or even a million.

THE END is HERE:

— Robert Kiyosaki (@theRealKiyosaki) May 21, 2025

WHAT if you threw a party and no one showed up?

That is what happened yesterday.

The Fed held an auction for US Bonds and no one showed up.

So the Fed quietly bought $50 billion of its own fake money with fake money.

The party is over. Hyperinflation is…

What Actually Happened in the Bond Market

The Federal Reserve does indeed conduct regular auctions of Treasury securities. However, repurchase operations—including those involving the Fed itself via the secondary market—are nothing new. They are a standard tool of monetary policy and, in themselves, do not indicate a failed auction.

As of this writing, there is no evidence that any recent auction failed outright. The U.S. Treasury publishes auction results publicly, and recent reports show demand remained balanced, albeit with signs of waning interest from foreign buyers. The referenced $50 billion purchase most likely refers to a routine quantitative easing or liquidity-support operation—not an emergency buyback of unwanted debt.

Hyperinflation? The Data Suggest Otherwise

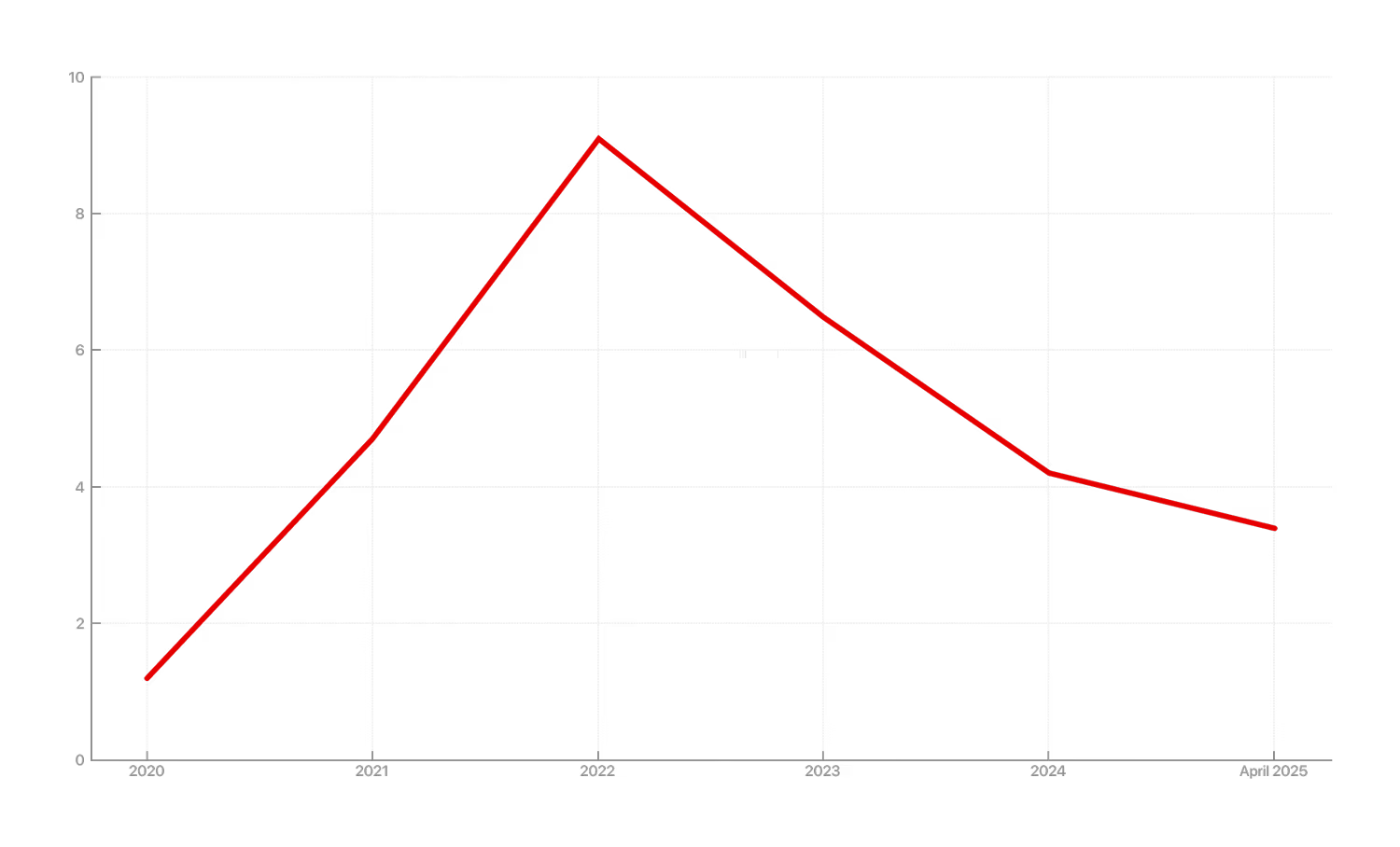

The current year-over-year inflation rate in the United States stands at around 3.4%, according to the Bureau of Labor Statistics (as of April 2025)—well below the highs of 2022 and nowhere near the levels that would constitute hyperinflation, as predicted by Kiyosaki.

U.S. Inflation Rate (CPI), 2020–2025

Inflationary pressures do persist—driven in part by government spending, deficits, and the national debt. But there is currently no indication of hyperinflation, typically defined as ≥50% per month, as seen in cases like Zimbabwe or Venezuela.

Alternative Assets—Safe Havens or Speculation?

Kiyosaki has long positioned himself as a proponent of gold, silver, and cryptocurrencies—not merely as hedges, but as alternatives to the entire financial system. His forecasts (gold at $25,000, Bitcoin at $1 million) are dramatic but lack grounding in market fundamentals. None of the major financial analysts—including Bloomberg, UBS, or Fitch—have issued projections even remotely close to these figures, even under stress-test scenarios.

Current Prices, Kiyosaki's Forecasts, and Market Consensus

Asset

Current Price (May 2025)

Kiyosaki's Forecast

Analyst Consensus

Gold

$3,329

$25,000

$3,065–$3,700

Silver

$33

$70

$33–$36

Bitcoin

$111,000

$500,000

$125,000–$160,000

Panic as a Strategy

Pessimistic predictions have become Robert Kiyosaki’s trademark in recent years. He has consistently forecast collapses in 2011, 2016, 2020, and 2023. But each new wave of alarmism is accompanied by a familiar pitch: buy what he deems the "lifeboats."

It increasingly appears that Kiyosaki’s public warnings are less about economic analysis and more about marketing. His message is tailored to an audience that no longer trusts the system—and is eager to believe in "anti-system" assets.

The Concern Is Real, but Hyperbole Dominates

The U.S. financial system is indeed under pressure—from rising debt and political battles over borrowing limits to an underlying reliance on market confidence. But there is no current evidence of hyperinflation or a breakdown of Treasury operations. Investors haven’t "left the party"—they’ve simply become more cautious.

For now, "the end" is more rhetorical flourish than economic reality. And perhaps, another way to sell a book.