The surge in gold and silver prices in recent weeks has become part of a sustained market trend: investors are steadily increasing allocations to precious metals amid mounting uncertainty in the global economy and US monetary policy. Markets received another impulse at the start of the week, when news out of Washington fueled doubts about the Federal Reserve’s independence and triggered a shift of capital into safe-haven assets.

On Monday, January 12, gold hit a record high, while the dollar and US equity futures fell after US prosecutors opened a criminal investigation into Federal Reserve Chair Jay Powell, intensifying concerns over the central bank’s independence.

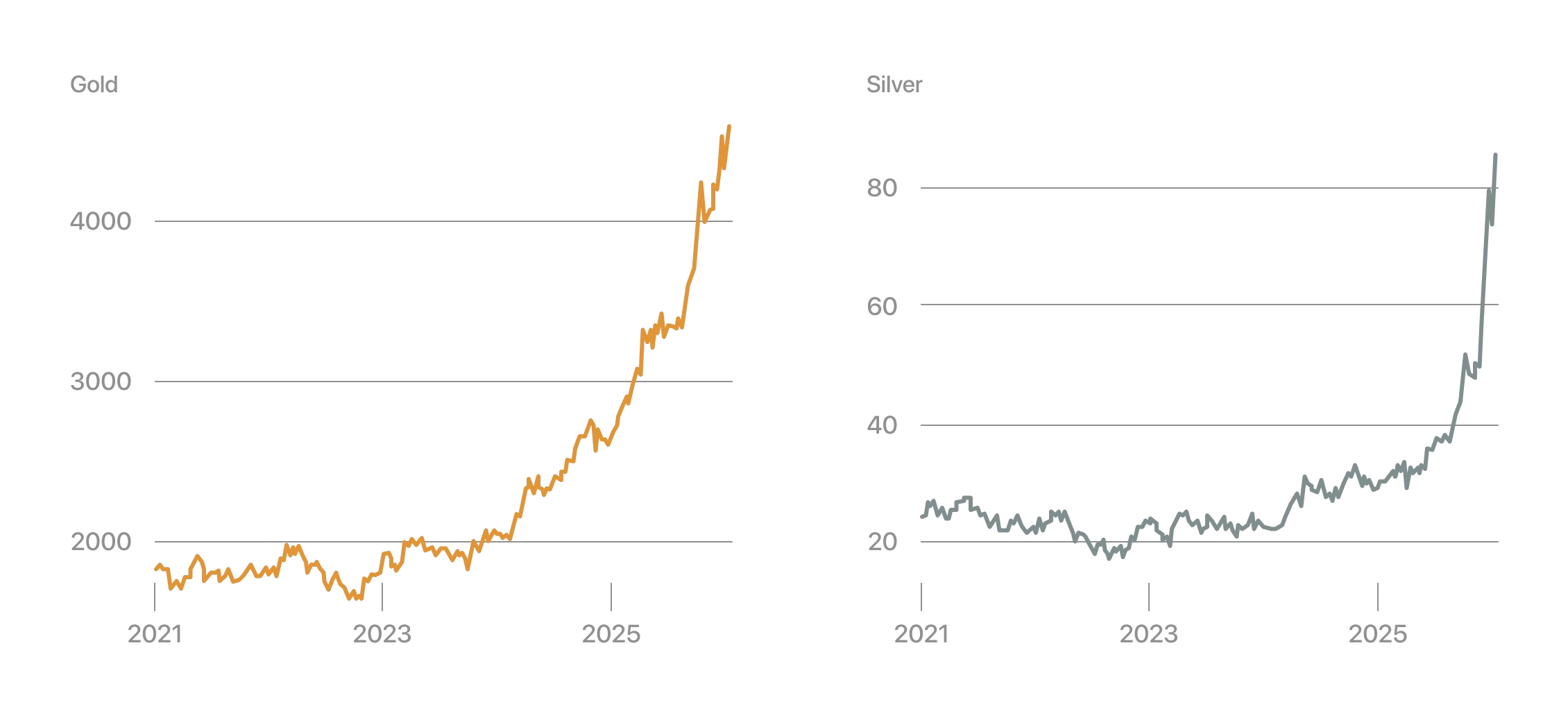

Prices for the precious metal rose by 2.2 percent—to $4,607 per troy ounce. The dollar weakened by 0.4 percent against a basket of major currencies, including the pound sterling and the euro. Silver climbed nearly 5 percent at its peak, reaching a new record of $84.60.

Futures on US stock indexes also moved into negative territory: S&P 500 contracts fell by 0.5 percent, while the technology-heavy Nasdaq 100 declined by 0.7 percent.

Yields on 10-year US Treasury bonds, which move inversely to prices, rose by 0.03 percentage points—to 4.20 percent.

Gold and silver price dynamics, $ per troy ounce

“The risk is that in the coming quarters the gloves will come off” in relations between the White House and the Fed, said Kevin Thozet, a member of the investment committee at asset manager Carmignac.

On Sunday, January 11, Powell said the Fed had received grand jury subpoenas and been threatened with criminal charges by the Department of Justice over his testimony to Congress regarding the $2.5bn renovation of the central bank’s headquarters.

According to market participants, movements in the dollar and gold reflect the risk that key US interest rates could be held at lower levels than would otherwise be the case absent political pressure. This, in turn, raises the likelihood of higher long-term inflation and adds to uncertainty over monetary policy.

“We have seen this before—political pressure on the Fed means a weaker US dollar, higher long-end Treasury yields, and rising inflation expectations,” said Mike Riddell, a fund manager at Fidelity International.

At the same time, the scale of market swings remained relatively moderate, as many investors continue to expect the regulator’s independence to be preserved.

“I still expect the committee to make decisions based on its mandate and the economic data,” said Goldman Sachs chief economist Jan Hatzius, speaking at a conference in London.

Gold and silver have moved to the center of what is known as the “debasement trade,” as investors fear that pressure for lower rates will over time erode the value of dollar-denominated assets. These concerns, combined with a broader flight to safety, have fueled the record surge in precious-metal prices.

“Gold is the key geopolitical-risk asset—more so than any other,” said John Woods, chief investment officer for Asia at Lombard Odier. “There is simply too much geopolitical risk in the market right now.”

Just over a week after US forces seized Venezuelan leader Nicolas Maduro, US President Donald Trump said he was considering military operations against Iran amid the regime’s harsh crackdown on nationwide protests.

The Justice Department’s investigation into Powell marked the continuation of a Trump administration campaign aimed at pressuring the Fed to cut interest rates more aggressively, despite persistent concerns about a resurgence of inflation.

The latest confrontation between the White House and the Fed is unfolding against an already challenging backdrop for long-term government bonds worldwide. Last week, the spread between yields on 30-year US Treasuries and two-year notes widened to 1.4 percentage points—the highest level in four years—driven by global concerns over the scale of government borrowing.

Inflation expectations could “gradually rise as the probability increases that a MAGA-aligned appointee ends up at the helm of the Fed,” Thozet of Carmignac noted.