When Brussels and Beijing announced their anniversary summit in January, it was framed as a chance to reboot EU-China dialogue amid growing global trade instability. But by July, there had been no rapprochement and little meaningful progress. Instead, the two sides meet in an atmosphere of overt detachment: without Xi Jinping’s participation and without breakthroughs on key issues—from tariffs on electric vehicles to export restrictions on rare earth metals. A summit meant to mark 50 years of diplomatic relations now risks becoming a mere formality against the backdrop of escalating global rivalry.

Tensions Are Mounting, but Solutions Remain Elusive

In two weeks, European Commission President Ursula von der Leyen and European Council President António Costa will arrive in China amid a protracted chill in EU-China relations. Officially, the summit is meant to celebrate 50 years of diplomatic ties, but the atmosphere is anything but celebratory. The two sides have accumulated dozens of serious disputes—from restricted market access for European firms to Europe’s growing dependence on Chinese supplies of strategic resources. At the same time, the protectionist shift in U.S. policy under Donald Trump has only made compromise more difficult.

On Tuesday, von der Leyen laid out a list of political and economic grievances against Beijing: state-subsidized overproduction, dumping practices, discrimination against foreign companies, and export restrictions. These accusations have set the tone for the upcoming summit. According to von der Leyen, China uses "unique instruments" to circumvent common rules and flood global markets with subsidized goods—not only to boost its domestic economy but also to "suffocate international competition."

A further source of friction came with China’s recent decision to bar European medical equipment manufacturers from public tenders—a tit-for-tat response to similar EU measures. This added to a growing list of mutual grievances, which already includes disputes over tariffs on electric vehicles, alcohol, and other goods.

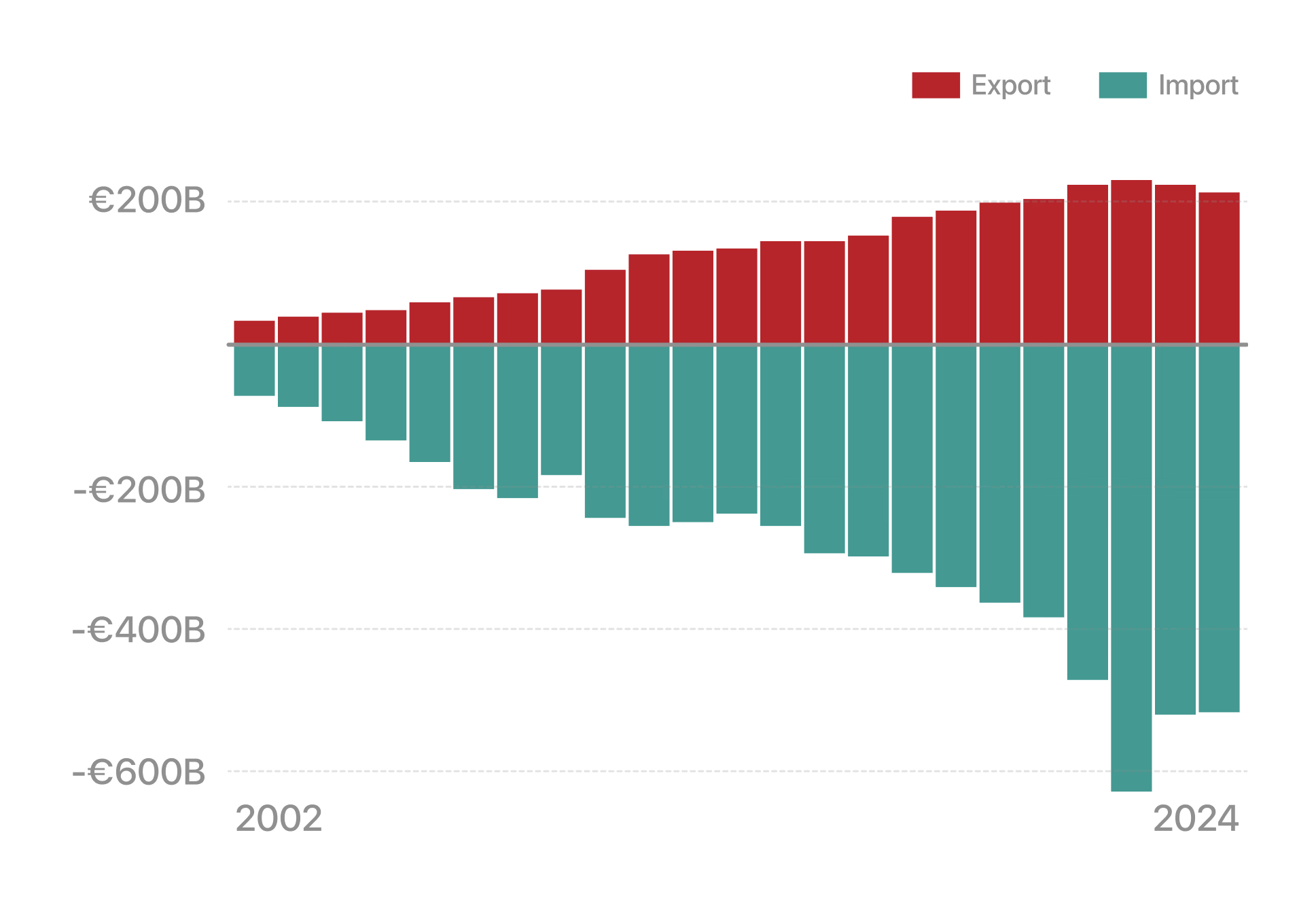

Trade Balance Between the EU and China

Symbolism Without Substance

Breaking with diplomatic tradition, Chinese President Xi Jinping has declined to visit Europe and is not expected to attend the summit in Beijing, scheduled for July 24 and shortened from two days to one. The meeting will likely be led by Premier Li Qiang. Separate talks between Xi, von der Leyen, and Costa remain a possibility—but have yet to be confirmed.

Xi’s decision signals deliberate distancing and has caused frustration in Brussels. "Xi not only didn’t come to Brussels—he may not even show up in Beijing… It’s humiliating," said Alicia García-Herrero, chief Asia-Pacific economist at Natixis. "As a European, I’d say: don’t go, don’t take that crap."

Against this backdrop, the EU and the U.S. are racing to finalize a provisional trade deal by August 1—the date Trump has set for deciding whether to resume broad tariffs. If an agreement is signed before the EU–China summit, it will increase pressure on Beijing. "If the EU and U.S. reach a deal similar to the U.S.–UK agreement, other trading partners will be at a disadvantage—and China will inevitably respond," noted a Chinese business representative.

Von der Leyen, meanwhile, sharpened her rhetoric and at the G7 summit accused China of using its dominance in strategic resources as a tool of coercion. The response was swift: Chinese Foreign Ministry spokesperson Guo Jiakun emphasized that China takes into account the "legitimate needs" of other countries and acts within the law.

When the summit was first announced—just days before Trump’s January inauguration—the tone in Brussels was conciliatory. The EU hoped to reboot its relationship with China amid tensions with Washington. But six months on, no meaningful progress has been made. On the contrary, China’s Ministry of Commerce has warned that any U.S. agreements that undermine China’s interests will have consequences.

Made in China

How China Conquered the Rare Earth Metals Market and Took Control of Global Supply

What It Means for the U.S. and Europe Amid Rising Geopolitical Competition

China Prepares for a Prolonged Trade War

Beijing Builds Economic Resilience and Bets on Domestic Demand

A Trade War With China That Is Nearly Impossible to Win

The U.S. Is Confronting the Consequences of Its Own Strategy

Economy, Climate, and the Absence of Dialogue

According to Maria Martin-Prat de Abreu, a senior European Commission official in charge of relations with China, the situation remains deeply uncertain. "Right now, 70% of EU exports to the U.S. could be subject to new tariffs. We are facing a major trade reallocation and extremely high levels of uncertainty," she said.

Another source of friction is rare earth metals. In response to U.S. measures, Beijing imposed export restrictions. Although EU Commissioner Maroš Šefčovič secured faster licensing for European firms, industry leaders continue to sound the alarm: critical supply chains—from smartphones to car engines—are under threat. China supplies 99% of the EU’s imports of all 17 rare earth elements.

Diplomatic relations are also deteriorating. The two sides do not plan to issue a joint final communiqué—only a press release, as was the case in 2023. "There’s still a huge amount of work to be done before the summit," admitted Martin-Prat de Abreu. The agenda includes both structural issues and specific topics, such as access for European agricultural products and cosmetics to the Chinese market. "It’s very difficult," she said.

Moreover, the traditional high-level trade dialogue has been canceled this year due to a lack of progress. Another deadlock concerns climate policy: the European Commission refuses to sign a joint climate declaration unless China commits to stricter emissions targets, according to the Financial Times, citing Commissioner Wopke Hoekstra.

"It doesn’t mean we slammed the door," clarified a third European official. "It’s more like we never opened it. We’re sending a signal—to both China and the U.S."