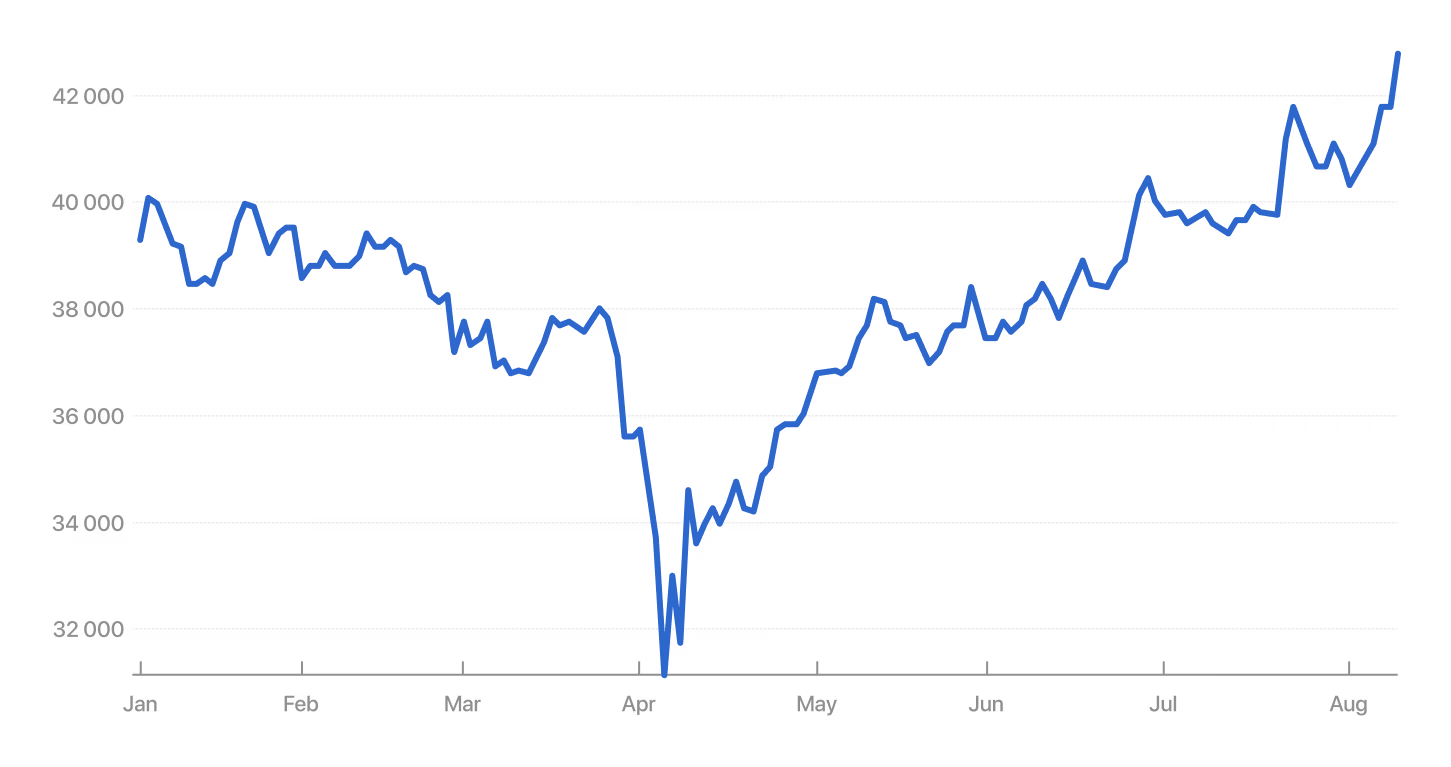

On Tuesday, August 12, Asian stock markets rose, with Japanese and Australian indexes hitting record highs after U.S. President Donald Trump decided to extend the trade truce with China.

Japan’s Topix index gained 1.4%, while the export-focused Nikkei 225 rose 2.2%, both reaching all-time highs. In Australia, the S&P ASX 200 climbed 0.4% to a record after the Reserve Bank cut interest rates to 3.6% and signaled the possibility of further easing. China’s CSI 300 added 0.5%.

On Monday, Trump signed an order extending the trade truce with Beijing for another 90 days—just hours before tariffs on imports from the world’s largest exporter were set to increase.

The U.S., the president noted, “continues to negotiate with China to address the lack of reciprocity in our economic relationship and the associated threats to our national and economic security.”

The extension of the truce is spurring investor appetite for risk assets, said Hao Hong, chief investment officer at the hedge fund Lotus Asset Management: “People now have another 90 days to act.”

Nikkei 225 Index, points

“The fact that we’re not returning to the trade war scenario we saw in April is a positive for global equity markets,” said Bruce Kirk, chief Japan equity strategist at Goldman Sachs.

He noted that Japan’s record equity rally is driven not only by trade agreements but also by the normalization of monetary policy, strong corporate earnings, and greater clarity in its relationship with the United States. “The deal has reaffirmed that Japan remains one of Washington’s key allies in the region, and investing in its market carries less geopolitical risk compared with other destinations,” he emphasized.

Tariff Policy of Trump

White House Tariff Policy Fuels Market Turmoil

Vague Statements, Last-Minute Adjustments, and Upcoming Court Rulings Undermine Investor Confidence

The U.S. Economy as a Source of Global Instability

American Policymaking Increasingly Resembles That of Emerging Markets

Analysts also note that Asian markets are benefiting from capital shifting out of U.S. assets. “Non-U.S. markets have been doing quite well,” said Hao Hong.

Meanwhile, performance in Europe and the United States was muted as investors awaited the release of U.S. inflation data, expected to signal the likelihood of a Federal Reserve rate cut in September. The Stoxx Europe 600 index rose 0.1%, while S&P 500 and Nasdaq futures were little changed.

Tuesday’s data was expected to show annual inflation rising to 2.8%, offering insight into how much of the sweeping tariffs imposed by the Trump administration are being passed on to U.S. consumers. The latest batch of tariffs took effect on August 7, though some restrictions have been in place for many months. The dollar remained steady on Tuesday morning ahead of the data release.