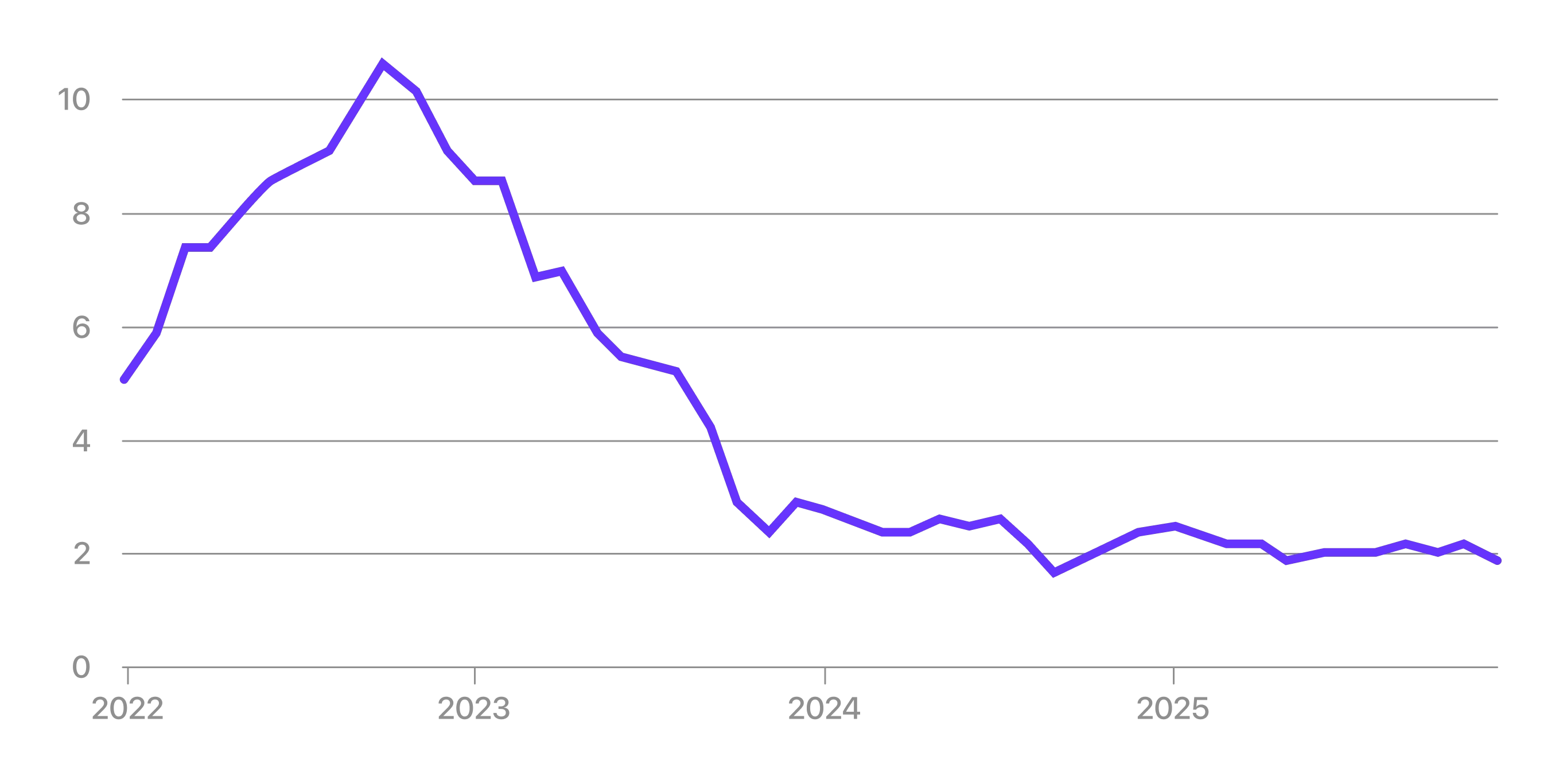

Eurozone inflation slowed to 2 per cent in December, reaching the European Central Bank’s target for the first time since the summer and strengthening the case for keeping interest rates unchanged.

Eurozone Inflation, %

The figure matched the forecast of economists polled by Reuters and came in below November’s reading of 2.1 per cent.

In December, the ECB held its benchmark interest rate at 2 per cent for the fourth consecutive meeting.

Most economists do not expect rate cuts this year. Earlier, the regulator halved borrowing costs in eight steps between mid-2024 and mid-2025.

The euro was little changed after the release of the expected data, remaining flat on the day against the dollar at 1.169.

The ECB expects inflation to average 1.9 per cent this year, down from 2.1 per cent in 2025. Economic growth, according to the regulator, is set to prove more resilient than previously anticipated. Central bank staff project GDP growth of 1.2 per cent this year, up from an earlier estimate of 1 per cent.

Core inflation, which strips out volatile food and energy prices, eased to 2.3 per cent in December from 2.4 per cent a month earlier.

A closely watched measure of services inflation—an indicator of domestic price pressures that had exceeded the ECB’s medium-term target of 2 per cent for more than three years—fell by 0.1 percentage point to 3.4 per cent after hitting its highest level since April in November.

“Inflation in services remains higher and more persistent than is consistent with the ECB’s target,” said Tomasz Wieladek, chief European macro strategist at T. Rowe Price, adding that it would “continue to cause concern” for the regulator. “The ECB’s rate-cutting cycle is clearly over,” he said.

Diego Iscaro, head of European research at S&P Global Market Intelligence, said the December inflation data were “unlikely to alter the ECB’s approach”.

“We continue to expect the ECB to keep interest rates unchanged for the foreseeable future,” he added.

Expectations of a further easing in inflationary pressures in recent days have helped push down euro-area government bond yields. The yield on ten-year German bunds fell by 0.04 percentage point on Wednesday—to 2.81 per cent, its lowest level since early December.

According to interest rate swap markets, traders are now pricing in only a small chance of an additional ECB rate cut this year, having unwound part of the December bets on rate increases by the end of 2026.

Mike Riddell, a bond fund manager at Fidelity International, said the latest data suggest that talk of an ECB rate increase had been “highly premature”, adding that the firm expects inflation to continue easing, in part due to lower energy prices.