Europe’s allies of Ukraine remain firm supporters of Kyiv in words, yet in practice they continue to buy Russian energy. As reported by Reuters, despite having nearly eliminated their dependence on Russian fuel since 2022, EU countries imported more than €11 billion worth of Russian energy in the first eight months of 2025. According to analysts, these payments help sustain an economy waging war on Ukraine—even as the European Union prepares to impose a full ban on Russian gas imports by 2028.

European countries, including France, remain among Ukraine’s staunchest backers in its confrontation with Russia. Yet at the same time, some are ramping up purchases of Russian energy, bringing Moscow billions of euros and feeding its wartime economy.

As the war nears its fourth year, the European Union remains in a vulnerable position—effectively financing both sides of the conflict. On one hand, it provides large-scale military and humanitarian aid to Kyiv; on the other, it continues making commercial payments to Moscow for oil and gas.

Since 2022, the EU has reduced its reliance on Russian fuel by about 90%. Nevertheless, according to Reuters analysis based on data from the Centre for Research on Energy and Clean Air (CREA) in Helsinki, EU member states imported more than €11 billion worth of Russian energy in the first eight months of this year. Seven of the bloc’s twenty-seven countries increased purchases compared with last year—including five that are among Ukraine’s most active supporters. Imports of Russian energy to France rose by 40% to €2.2 billion, while in the Netherlands they jumped 72% to €498 million.

The study noted that LNG terminals in France and Spain serve as entry points for Russian supplies into Europe, even though the gas is often not consumed domestically but instead flows onward to other EU buyers.

CREA expert on EU-Russia relations Vaibhav Raghunandan described the rise in imports as “a form of self-sabotage” by some states, reminding that energy exports remain Russia’s primary source of revenue during its war against Ukraine, which the EU supports.

“The Kremlin is literally being funded to continue its military campaign in Ukraine,” he stressed.

European Countries Increase Imports of Russian LNG, Citing Existing Contracts and Lack of Sanctions

France’s Energy Ministry told Reuters that the rise in the value of Russian energy imports this year reflects deliveries to clients in other countries, without specifying which nations or companies were involved. According to analysts at Kpler, part of the gas purchased by France is later transferred to Germany.

Dutch authorities said that while the Netherlands supports EU plans to phase out Russian energy, the country cannot cancel existing contracts between European energy companies and Russian suppliers until such measures are legally codified at the Union level.

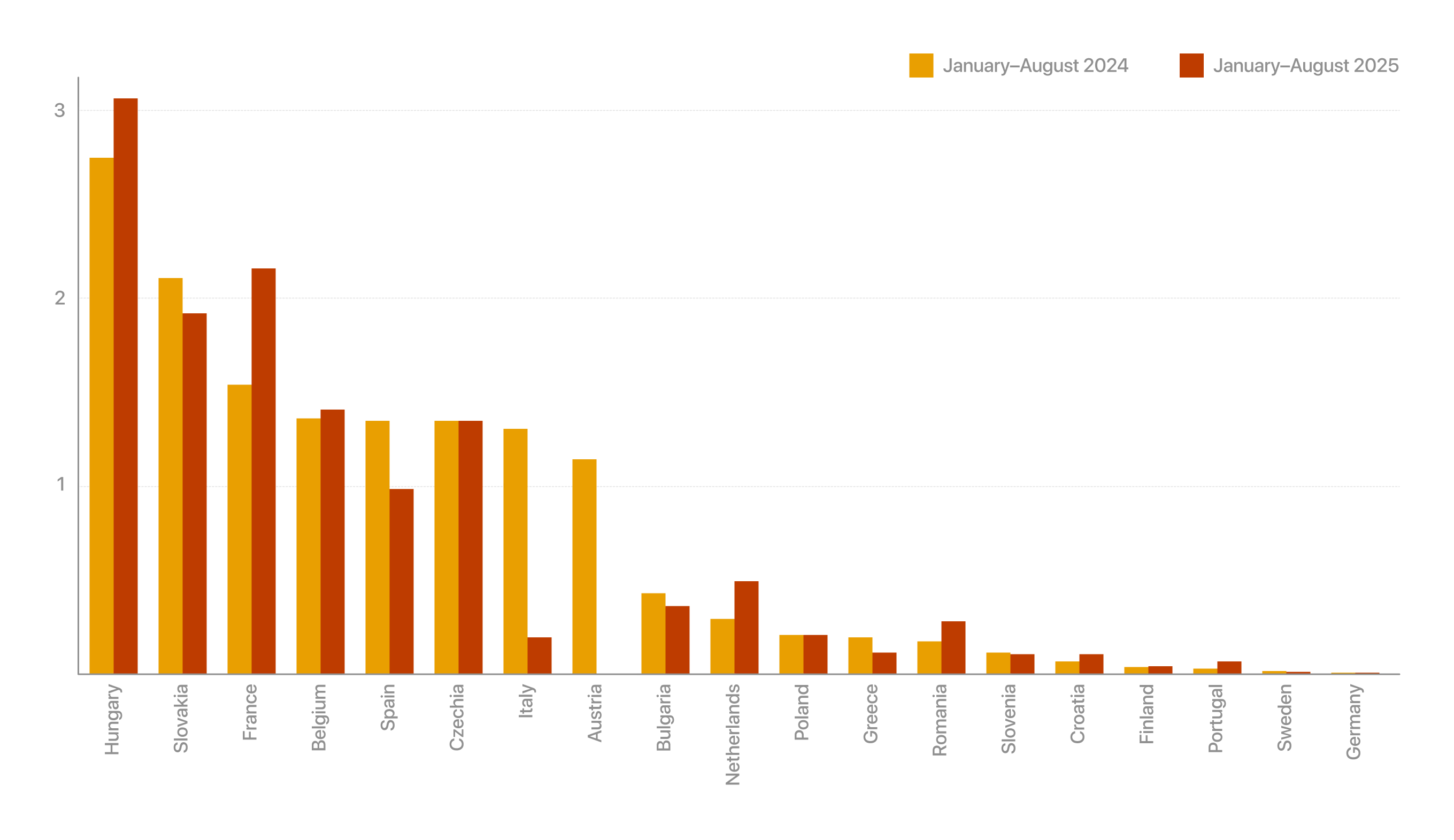

Value of Russian Energy Imports to the EU, € Billion

The EU, which has already banned most imports of Russian oil and petroleum products, announced plans to accelerate a full ban on Russian liquefied natural gas (LNG)—bringing the deadline forward to 2027 from the previously planned 2028. According to CREA, LNG is now the largest component of Russian energy imports to Europe, accounting for nearly half of their total value.

The European Commission declined to comment on 2025 import data. However, the EU’s energy chief said last month that the gradual phase-out of Russian fossil fuels has been designed to prevent price spikes and supply disruptions.

Under the proposal, a full ban on Russian oil and gas imports is set to take effect by 2028—meaning European money could continue fueling Russia’s wartime economy for at least another year.

Former U.S. President Donald Trump has argued that American oil and gas could replace the lost Russian volumes, and many analysts agree that such substitution is technically possible, though it would deepen Europe’s dependence on U.S. supplies—at a time when Washington is increasingly using tariffs as a foreign-policy tool.

“The EU agreed to increase purchases of U.S. energy to meet Washington’s persistent demands to end imports from Russia,” said Anne-Sophie Corbo, a research scholar at Columbia University’s Center on Global Energy Policy. “However, the notion that American LNG can fully replace Russian supplies is an illusion. U.S. exports are controlled by private companies that do not follow orders from the White House or the European Commission—they act according to their own commercial interests.”

"Helping to Weaken Russia"

The More Russian Gas France Buys, the Louder Its Promises Not to Let Moscow Prevail in Ukraine

Paris Remains the EU’s Largest Importer of Russian LNG Despite Calls for an Embargo

Russia Circumvents Sanctions to Import Austrian Machinery Suitable for Forging Howitzer Barrels

Britain Condemns Russia’s War Against Ukraine but Buys Gas From TotalEnergies, Which Exports It From Russia

Politico Found the Company Supplies the Prime Minister’s Residence and Dozens of Government Buildings

Court in The Hague Lifts Freeze on Gazprom’s Assets in the Netherlands

Ukrainian Claims Rejected Over 'Sovereign Immunity' Principle

Despite Reduced Imports, Eastern Europe’s Dependence on Russian Gas Remains Significant

In 2021, before Russia’s invasion of Ukraine, imports of Russian energy totaled more than €133 billion, according to CREA data. Between January and August of this year, that figure stood at €11.4 billion—a fraction of prewar levels and 21% lower than during the same period in 2024.

Hungary and Slovakia, which maintain close ties with the Kremlin and reject calls to abandon Russian gas, remain the largest importers, accounting for €5 billion of the total. They will not be affected by the EU’s upcoming ban on Russian LNG imports, which requires unanimous approval from all member states: until 2028, they will still be able to receive gas via pipelines.

According to CREA, Hungary was among the seven countries where the value of Russian energy imports increased—by 11%. Alongside France and the Netherlands, growth was also recorded in four nations whose governments openly support Ukraine: Belgium (up 3%), Croatia (up 55%), Romania (up 57%), and Portugal (up 167%).

Belgium’s Energy Ministry attributed the rise to other EU sanctions that took effect in March, banning “transshipment”—the reloading of Russian LNG for shipment outside the bloc. As a result, gas arriving at Belgian ports must now be unloaded onshore rather than transferred ship-to-ship for further delivery to end buyers.

Portugal’s Energy Ministry noted that the country purchases only small volumes of Russian gas and that overall imports this year will be lower than in 2024. The governments of Croatia and Romania did not respond to requests for comment.

According to CREA estimates, since the start of the war in 2022, total imports of Russian energy by EU countries have exceeded €213 billion. That figure significantly surpasses the aid provided to Ukraine over the same period: according to Germany’s Kiel Institute for the World Economy, the EU has delivered €167 billion in financial, military, and humanitarian assistance, remaining the country’s largest donor.

Long-Term Contracts and the Lack of a Ban Allow European Companies to Keep Buying Russian Gas

French company TotalEnergies is among the largest importers of Russian liquefied natural gas in Europe. Other major players include Shell, Spain’s Naturgy, Germany’s SEFE, and the trading house Gunvor. All operate under long-term contracts extending into the 2030s and 2040s.

TotalEnergies told Reuters that it continues deliveries from Russia’s Yamal LNG plant under agreements that cannot be suspended without official EU sanctions. The company stressed that it will maintain supplies as long as European governments deem Russian gas essential for energy security.

Shell, Naturgy, and Gunvor declined to comment on imports from Russia.

According to Ronald Pinto, principal gas market analyst at Kpler, companies are unwilling to risk violating their contractual obligations without a solid legal basis such as an EU-wide ban on Russian LNG imports. “In the end, it’s not governments buying this gas but market players—and most of them are sticking firmly to their long-term contracts,” he said.

Pinto added that flow analyses show Russian LNG imported by France often travels through pipelines to Belgium and then on to Germany, where industrial demand remains high. He also noted that “it’s impossible to trace the exact movement of gas molecules within the European network.”

A spokesperson for SEFE, which manages 10% of Germany’s gas transmission network, confirmed that the company does indeed receive Russian gas via France and Belgium.

Germany’s Economy Ministry told Reuters that it supports the EU’s efforts to gradually phase out Russian energy, but SEFE remains bound by a long-term LNG purchase contract with the Yamal LNG plant that cannot be terminated.

“Under the take-or-pay principle, SEFE is obliged to pay for the agreed volumes even if the deliveries are not physically accepted,” a ministry spokesperson explained. “Refusing to take the shipments would allow Yamal to resell the same volumes—ultimately giving Russia a double financial benefit.”