Over the past four months, the European Union has cut spending on oil and gas imports from the United States by 7%, despite a pledge made to Donald Trump to purchase $750bn worth of US energy resources over three years.

After concluding a trade agreement with Washington in August, the EU did increase the physical volumes of US liquefied natural gas it purchased. Falling oil and gas prices, however, meant that the total value of imports was lower than over the same period last year.

According to estimates by the energy consultancy Kpler, the value of oil and LNG imports into the EU between September and December amounted to $29.6bn.

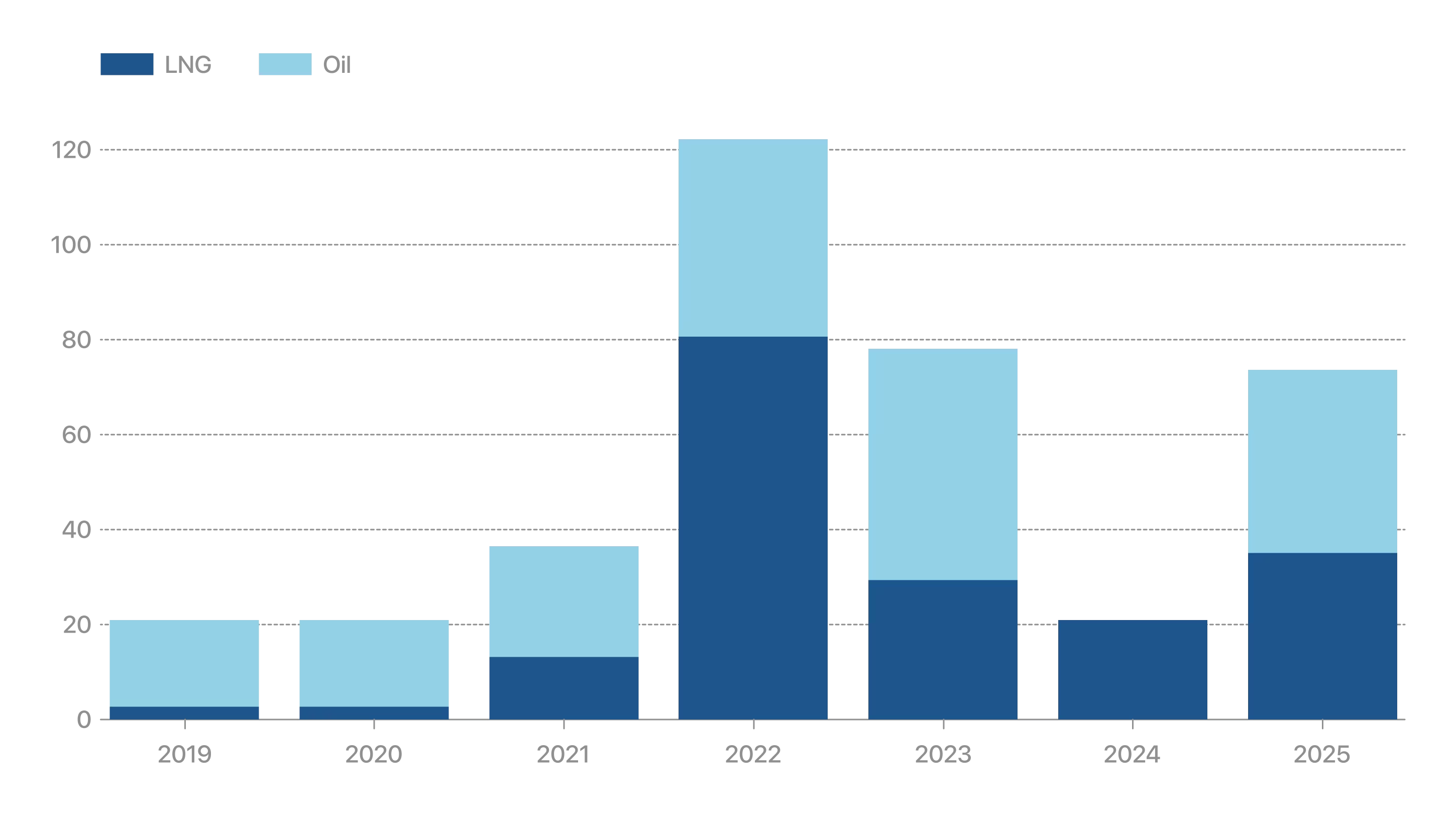

EU Energy Imports From the US Declined in 2025

Jillian Boccara, a senior director at Kpler, said the non-binding nature of the trade agreement has had little impact on additional purchases of US commodities.

She noted that energy supply contracts are concluded on a bilateral basis and driven by economic considerations—including shipping costs and margins—rather than political statements. She also stressed that the announced volume of purchases is “unrealistic”.

On an annual basis, EU imports of energy resources from the US reached $73.7bn—less than a third of the amount required to meet the $750bn commitment for the 2026–2028 period. Nuclear energy products, including uranium, which are also covered by the trade agreement, account for less than 1% of energy trade between the EU and the US.

According to the price reporting agency Argus Media, even if Russian gas were fully replaced with US LNG, the European Union would be able to import roughly $29bn a year in energy resources from the United States over the next three years—only about 23% of the volume envisaged under the terms of the agreement.

To formally reach the target, gas prices would have to quadruple—to $37.3 per million British thermal units by 2028. Such a scenario runs directly counter to current market expectations: according to Argus, 2028 futures are trading at around $8.2 per mmbtu, compared with roughly $10 at present.

The $37.3 per mmbtu level was last recorded in December 2022—during the energy crisis triggered by Russia’s invasion of Ukraine, when both prices and EU LNG purchases surged sharply.

Jillian Boccara of Kpler stressed that even a full replacement of Russian gas with US supplies would not be sufficient to triple the value of imports. “We see no coherent economic rationale here other than the fact that [the deal] serves as a way to reduce [US] tariffs,” she said. “We simply don’t see the math adding up.”

Markets, by contrast, are pricing in an oversupply and falling prices in the coming years, as the United States, Qatar, and Canada plan to expand production. The prospect of a ceasefire between Russia and Ukraine has further dampened sentiment.

According to Martin Senior of Argus, neither the EU nor the US has sufficient infrastructure—including storage and regasification capacity—to materially expand energy trade. The European Union would need to increase import capacity by more than 50%, while the United States would have to more than double its export potential to come close to meeting the agreement.

The absence of an economic rationale, said a former member of the European Parliament with extensive experience in energy policy, makes the deal less a viable plan than an attempt to buy time and defer a direct confrontation with the US president, whose term expires in January 2029, while simultaneously strengthening defenses against Russia. “The reckoning needs to be postponed. And perhaps by then the war will already be over,” he said.

The European Commission said it purchased roughly €200bn ($236bn) worth of US energy resources in the first 11 months of 2025. Imports of oil and gas—particularly US LNG—were increased, and total purchases of American LNG in 2025 are expected to reach 70bn cubic metres, up from 45bn a year earlier.

“This trend will continue: this year European buyers have signed at least nine new long-term contracts for LNG supplies from the United States,” a Commission spokesperson said.

It remains unclear, however, what share of future deliveries is included in the aggregate figure cited by the Commission. The total also includes a Polish deal to purchase three nuclear reactors from Westinghouse as part of a €42bn power plant project.