On April 2, U.S. President Donald Trump announced sweeping tariffs on nearly all goods from major trading partners. China responded immediately: by April 11, tariffs on Chinese exports to the U.S. had reached 145%, while those on American goods entering China hit 125%. Without a negotiated settlement, the $700 billion bilateral trade flow could shrink by as much as 80% within two years. Financial markets tumbled in response, and analysts remain divided—was this escalation a calculated move or a political gambit lacking strategic clarity?

Misjudged Resolve: The U.S. Underestimated Beijing

The Trump administration assumed that China’s economy would buckle under pressure, prompting Xi Jinping to make concessions in the name of stability. This fostered a false sense of leverage in Washington and led to a misreading of both the speed and severity of China's response.

Beijing, for its part, made no effort to ease Western concerns over a renewed wave of cheap Chinese exports—the same dynamic that hollowed out much of the industrial West in the 2000s. Instead, Chinese officials adopted a combative tone. In March, the Chinese embassy in Washington declared that China was "ready to fight to the end"—not only in a trade war, but in any confrontation. This show of resolve brought neither compromise nor international confidence in Beijing’s willingness to de-escalate.

The People's Bank of China.

Negotiating Deadlock: Incompatible Political Approaches

The White House shifted from attempts to reshape the global trading system to exerting direct pressure on the Chinese economy. Xi and his inner circle harbor no illusions: China cannot win a full-scale trade war with the United States, but they are prepared to prolong the standoff, banking on mounting domestic costs in Washington.

Trump relies on overt diplomatic theatrics. Every decision is announced personally; he insists on being seen as the "chief negotiator." Xi, by contrast, remains removed from daily proceedings, endorsing outcomes only after internal consensus is reached and avoiding direct engagement. This divergence in political style makes compromise unlikely: in Beijing, a face-to-face meeting with Trump is viewed as a concession—offering little tangible benefit and considerable reputational risk.

Chinese officials recall how trade tensions escalated sharply following Trump’s 2017 visit. They also fear a scenario akin to the Trump-Zelensky encounter, where disagreements were exposed to public scrutiny. In the logic of Chinese politics, such outcomes are unacceptable.

Internal Recalibration: How Beijing Is Adapting to Trade Pressure

In recent years, China has undertaken extensive preparations for a future of trade isolation. Its industrial base has been adjusted to withstand restrictions, supply chains have been reinforced, and state-owned enterprises along with local governments have been mobilized to support domestic demand and employment. New laws on export controls, sanctions, and anti-espionage measures have been enacted—creating a legal trap for multinational firms caught between competing U.S. and Chinese regulatory regimes.

Authorities are also investing in yuan-based financial infrastructure to reduce reliance on the U.S. dollar. The government is doubling down on fiscal stimulus, support for small businesses, and an accelerated transition toward a consumption-driven economy.

Ideologically, the shift is accompanied by renewed rhetoric of "eating bitterness" (chiku)—a call for public resilience in the face of external pressure. The reappearance of Jack Ma in public life signals a partial return to the private sector, albeit under tighter state control.

A Miniso store in Shanghai on the eve of the National People's Congress.

China's External Strategy: Strengthening Ties Beyond the U.S.

On the international stage, Beijing is working to blunt the impact of American protectionism. Talks are underway on free trade zones with the Gulf states, consultations have resumed with Japan and South Korea, and dialogue with the EU is being reinforced. At a ministerial meeting in Southeast Asia, Xi Jinping reaffirmed the priority of economic ties with Vietnam and other key transit countries.

China is presenting itself as a stable alternative to Washington. In April, the People’s Daily urged investors to "use China's certainty as a hedge against American unpredictability." Yet structural weaknesses in the Chinese economy persist, and the goal of achieving sustainable growth remains uncertain.

An Alternative to Ultimatums: A Viable Path to a Deal

Trump’s America First approach does not inherently require maximum pressure. A more nuanced strategy would be to present Beijing with a dilemma. For instance, the U.S. could tolerate a continued trade deficit, but seek to shift its structure—pursuing a surplus in strategically critical sectors such as semiconductors, artificial intelligence, and clean energy, while encouraging China to resume investment in U.S. assets.

A partial return to purchasing U.S. Treasuries could inject up to $43 billion in capital and help stabilize the American bond market—particularly crucial as Washington faces the challenge of refinancing $36 trillion in national debt. Such a move would signal continued commitment to the dollar system and dampen speculation about de-dollarization.

Sectoral tariffs, calibrated for gradual reduction in exchange for increased U.S. imports, could allow both sides to save face while redistributing the economic burden. This framework appears realistic—especially given the limited time, resources, and political latitude available to either party.

An automotive production line at a factory in Suqian.

Demography and Legitimacy: A Generational Risk for Both Nations

Growth in China has slowed, though it has yet to slide into recession. According to JPMorgan, the U.S. economy is also expected to decelerate in the second half of 2025. In both countries, decisions are made by aging elites, while the consequences fall on the young.

In China, the post-1970s generation expects sustained progress, not self-sacrifice. After the shock of the COVID-19 pandemic, growing tensions with the U.S. are increasingly seen as a threat to personal futures—limiting access to global education and career pathways. The social contract is fraying, and the willingness to "eat bitterness" may not endure.

In both the U.S. and China, there is a mounting sense that those in power are mortgaging the future of younger generations for short-term advantage. This creates long-term risks—and makes the pursuit of a balanced deal a strategic imperative.

Made in China

Fifty Years Without Reciprocity

The EU–China Summit Takes Place Amid Trade Disputes and Deep Diplomatic Chill

China Rehearses a Blockade of Taiwan

Beijing is Pressuring the Island Through Drills, Laws, and Economic Leverage, Aiming to Break Its Resistance by 2027—Before the U.S. Can Intervene

A Trade War With China That Is Nearly Impossible to Win

The U.S. Is Confronting the Consequences of Its Own Strategy

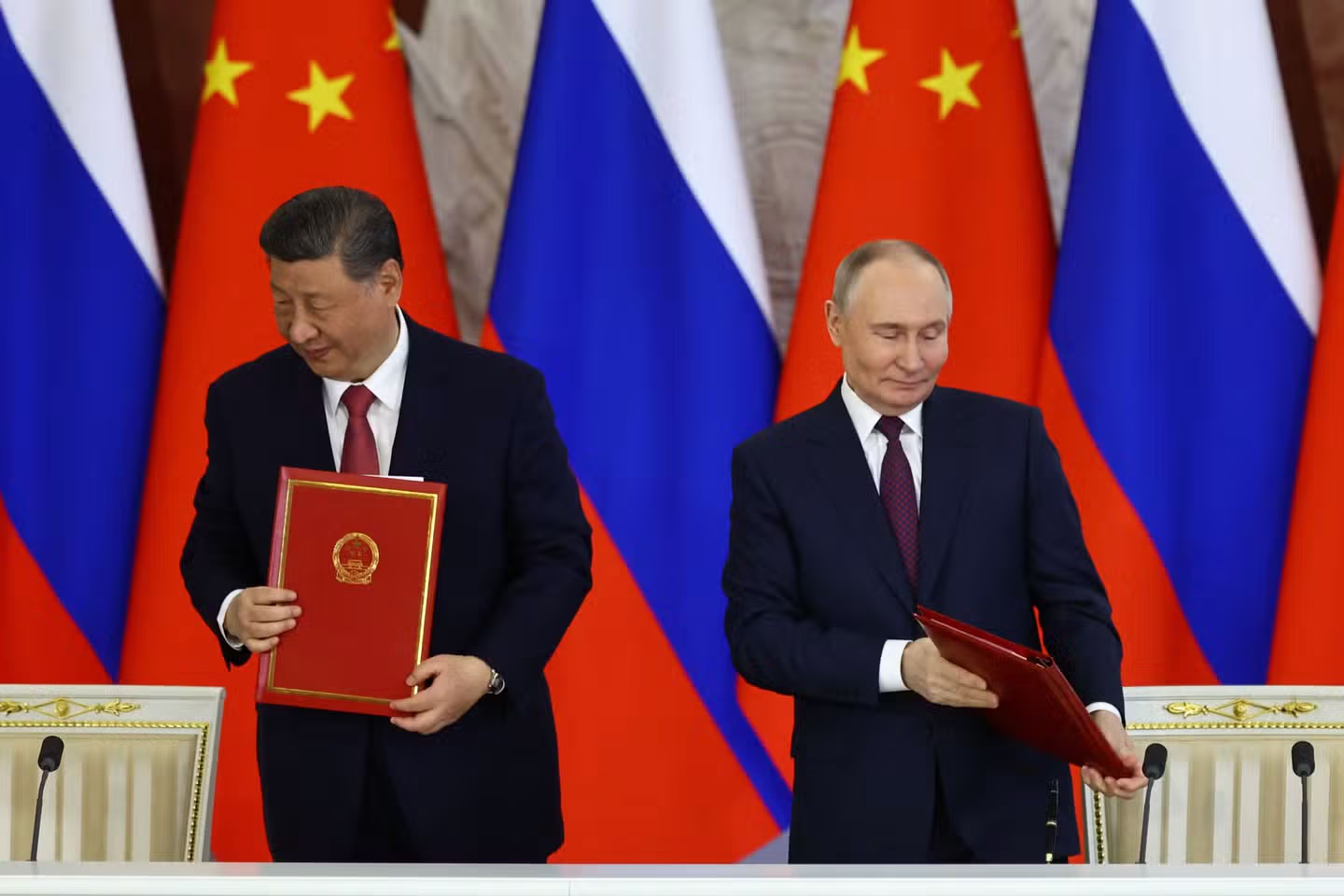

An Alliance Doomed to Asymmetry

Why Strategic Rapprochement With China Is Leading to a New Russian Dependency

Rapid Ascent, Heavy Toll

The deaths of top AI experts raise questions about the cost of China’s technological rise