After a week of escalating global trade tensions, Donald Trump unexpectedly hit pause. The U.S. President announced a 90-day delay in the introduction of new tariffs for dozens of countries—excluding China, against which the tariff pressure is only intensifying. This sudden shift fits neatly into the broader drama of the tariff conflict, which increasingly resembles a well (or not so well) choreographed show: the main character alternates between the role of tough protectionist and that of affable negotiator.

Trump’s decision to temporarily soften the blow for allies, leaving only Beijing as the "bad guy", reshapes perceptions of his strategy and raises questions—is this a calculated move or an improvised response to mounting pressure?

Just a week ago, Trump announced unprecedented tariffs against virtually the entire world—211 countries and territories—framing it as a "declaration of economic independence" for the United States. He boasted that he was being "generous" by raising tariffs to only half the level that, according to him, other countries impose on U.S. exports. In reality, the planned tariffs ranged from 10% to 50%: a base rate of 10% for all, with higher rates for specific countries—34% for China, 20% for the EU, and 26% for India. These measures would raise the U.S. average tariff rate to around 22% (compared to just 2.5% a year ago)—a level not seen since the early 20th century and approaching records set during the Great Depression.

Behind the bluster lies a long-standing American issue: a chronically high trade deficit. Trump’s goal with the new tariffs was to target countries with which the U.S. runs the largest trade imbalances.

Countries with the Largest U.S. Trade Deficit in 2024

Country

Trade Deficit, USD Billion

China

295.4

Mexico

171.8

Vietnam

123.5

Ireland

86.7

Germany

84.8

Japan

68.5

South Korea

66

Canada

63.3

India

45.7

Thailand

45.6

What is a trade deficit?

A trade deficit occurs when a country imports more goods and services than it exports. For the U.S., this means that in its trade relations with the listed countries in 2024, Americans bought significantly more from them than they sold.

Why does it matter?

For Donald Trump, whose economic policy is built on protectionist principles, a trade deficit is a sign of unfair conditions. As part of his new 2025 tariff campaign, he is using these imbalances as justification for imposing high duties. The goal is to reduce imports, boost domestic production, and bring jobs back to the U.S. As a result, countries with the largest trade surpluses with America—such as China, Mexico, and Vietnam—became the first targets in this new economic confrontation.

A trade deficit occurs when a country imports more goods and services than it exports. For the U.S., this means that in its trade relations with the listed countries in 2024, Americans bought significantly more from them than they sold.

Why does it matter?

For Donald Trump, whose economic policy is built on protectionist principles, a trade deficit is a sign of unfair conditions. As part of his new 2025 tariff campaign, he is using these imbalances as justification for imposing high duties. The goal is to reduce imports, boost domestic production, and bring jobs back to the U.S. As a result, countries with the largest trade surpluses with America—such as China, Mexico, and Vietnam—became the first targets in this new economic confrontation.

So why did Washington backtrack just days later? The official version from the White House is that dozens of countries reached out to the U.S. requesting negotiations and refrained from retaliatory measures, so they were granted a grace period. Trump colorfully claimed that foreign leaders were so desperate for a deal they were "kissing his ass" to lower tariffs. This crude bravado reflects the president’s belief that his tough stance has paid off—partners have been "broken" and are ready to make concessions. The decision to pause the increased tariffs for 90 days (while maintaining the flat 10% duty) serves as a kind of reward for those who, in Trump’s view, are "behaving well".

At the same time, China—which responded with tit-for-tat measures—has been cast by Trump as one of the "bad actors". Beijing is not only excluded from the pause—U.S. tariffs on Chinese goods are immediately raised to an astronomical 125%. That’s more than double the already enacted 104% duty on Chinese imports. This stark contrast of "carrot and stick" invites comparisons to the classic "good cop, bad cop" tactic. Observers had previously noted that U.S. allies effectively allowed Washington to play the "bad cop"—punishing rule-breakers alone while they played the "good cop" and filled the gaps left on the American market. Now, it seems, Trump has decided to play both roles himself: first aggressively "punishing" everyone, then generously "pardoning" many—while still "punishing" one.

Domestically, Trump aims to project strength and determination to his voter base by delivering on his promise to shield American factories from "unfair competition". It’s no coincidence that he declared the tariffs "our Act of Economic Independence" during a special White House ceremony in the Rose Garden—grandly titled "Liberation Day". The administration claims a dual objective: to collect trillions in import duties and simultaneously force manufacturing to return to the U.S. The problem is, these goals are mutually exclusive—if factories truly do return, revenues from duties will fall short, and vice versa. As Trump walks this tightrope, his advisors are playing their own roles in the performance: notorious protectionist Peter Navarro enthusiastically calculated that the new tariffs would bring in $6 trillion and help shrink the budget deficit. More moderate voices, however, have warned of recession risks—and judging by recent events, it seems those arguments may have finally reached the president.

It’s possible that the 90-day delay was part of the White House's negotiation strategy from the start. From the outset, analysts speculated whether Trump was bluffing—setting the stakes high only to later walk some of it back and extract concessions. In his book The Art of the Deal, Trump described the tactic of aggressive bargaining: make extreme demands, then "be willing to move," creating the illusion of compromise. The current shift in tone fits this playbook. "We've reached a turning point in the conflict—Trump is giving countries willing to make a deal time to sort things out," one U.S. analyst noted. According to him, the president is "stranding China on an economic island", aiming to isolate Beijing from the rest of the world. In theory, such a tactic could strengthen America's hand: alarmed by the prospect of a global trade blockade, partners might prefer to make deals with Washington and apply joint pressure on China as the rule-breaker. In this script, the U.S. plays the "bad cop", its allies the "good cop"—and China folds.

But the suddenness and disarray of Trump’s actions may also point to improvisation under pressure. Notably, the pause announcement caught even his own officials off guard: the news broke in the middle of a congressional hearing where the U.S. Trade Representative was passionately defending the tariffs. "Looks like your boss just pulled the rug out from under you," a Democratic congressman quipped, calling the situation "an amateur circus". Moreover, as Politico reported, the administration initially struggled to clearly communicate to partners what it actually wanted from the negotiations—or under what conditions the tariffs might be lifted. Around 70 countries complained they had sent letters and placed calls to Washington offering to talk tariffs—but received no response. This suggests the 90-day reprieve may be less a clever tactical move and more a desperate firebreak—a scramble to contain the fallout from the original decision.

By early July, countries at risk of being hit by tariffs will need to either strike deals with Washington or brace for renewed escalation. A marathon of backroom talks and sector-specific bargains is likely. Some nations will try to pull the U.S. into mutual tariff waivers—for instance, the EU may offer to ramp up imports of American liquefied natural gas or agricultural goods in exchange for shielding its auto industry from a 25% levy. South Korea and Japan might pledge to open their markets further to U.S. exports—such as farm products—to avoid a return to higher duties. India could fast-track resolution of its trade disputes with Washington to escape the 26% tariff. Ideally, Trump would like to showcase a string of "winning" bilateral deals by July—proof that his tough stance is yielding concessions. This would feed into his campaign narrative (even though the next election is three years away, the campaign is effectively underway).

However, there's no guarantee that three months will be enough for meaningful progress. Fears of a recession in the U.S. and globally have not gone away. Moody's analysts estimate that if 20% tariffs become a long-term reality, U.S. unemployment could rise to 7.3% by 2027 (from ~4% now), and stock markets could drop another quarter from current levels. Banks are tightening lending standards amid perceived risks, which is already cooling the economy. Jamie Dimon has warned bluntly that the current situation is likely to end in a downturn unless the "tariff issue" is resolved. Trump, too, understands that an economic recession would destroy his political prospects. So most likely, he will do everything possible to delay a full-scale trade rupture until 2026 (when midterm elections take place). It’s entirely possible that after 90 days he will again extend the grace period for allies under the pretext of "progress" in talks—just to prevent a market collapse.

Beijing, judging by its response, seems determined to withstand the pressure. Chinese media emphasize that the country has faced American protectionist waves before—from the Opium Wars to the trade tensions of the 1980s—and emerged stronger each time. Of course, the stakes are higher now, but China also has tools of its own: from devaluing the yuan to blocking exports of strategic materials (like rare earth metals critical to U.S. electronics). Neither side is currently showing a willingness to make fundamental concessions. "China’s aggressive counter-strategy minimizes the chances of a quick deal between the world’s two largest economies," notes an analyst at Rystad Energy. This duel risks dragging on, fueling the likelihood of a global recession. If talks between the U.S. and other countries also break down and Washington raises tariffs again in July, the world economy could be pushed to the brink. "What we've all feared—the end of globalization as we knew it," one observer grimly concludes. In such a scenario, supply chains would realign along political blocs, consumer prices would rise (a Yale University estimate puts the cost at a minimum of $3,400 per year for the average American household), and geopolitical tensions would escalate.

There is, however, a more optimistic scenario: the truce could become a first step toward a new agreement. In Washington, some have begun discussing a "new architecture of global trade" that reflects current geopolitical realities. Ideally, the U.S. could lead a coalition of allies in setting unified demands for China—from intellectual property protections to fair competition with state-owned enterprises. If Trump were to turn the past days' chaos into such a strategy, history might credit him as a leader who broke outdated rules to build a fairer system (albeit through shock therapy). But that would require the delicate art of diplomacy and coordination—the very multilateralism Trump has long rejected. So far, his approach resembles a solo performance more than a carefully orchestrated coalition.

"Don't worry, everything will be fine," Trump wrote on his social media platform, urging businesses "not to panic and to move production back to the U.S." But such reassurances do little to calm foreign partners—each has its own red lines. Perhaps the main achievement of the 90-day pause is that it gave all sides a chance to catch their breath and return to negotiations instead of trading blows. Global markets found hope that the worst-case scenario—an all-out trade war of everyone against everyone—might still be avoided. But this "intermission" doesn't mean the curtain has fallen. As they say in Hollywood, "to be continued"—the next chapter of this geoeconomic saga remains unwritten. Business and politics worldwide are holding their breath, awaiting the next twist in this unfolding drama. One can only hope that, in the act to come, reason will prevail over recklessness—otherwise, the Great Trade Pause of 2025 may go down in history as nothing more than a brief calm before the storm.

Trump-Pump-Pump

The U.S. Shuts Down Programs Investigating Russia’s Crimes in Ukraine

Military Atrocity Initiative Closed, Data on Child Deportations Frozen, Cooperation with The Hague Halted

He Did It

Trump Sends U.S. Trade Policy Back to the 19th Century with a Ridiculous Justification for Extreme Tariffs

Who Invented Trump’s Tariff Policy That Shook Global Markets?

Meet Peter Navarro

Politics of Loud Threats

Ultimatums as Donald Trump’s State Strategy

Trump Plans to Take All of Ukraine’s Natural Resources

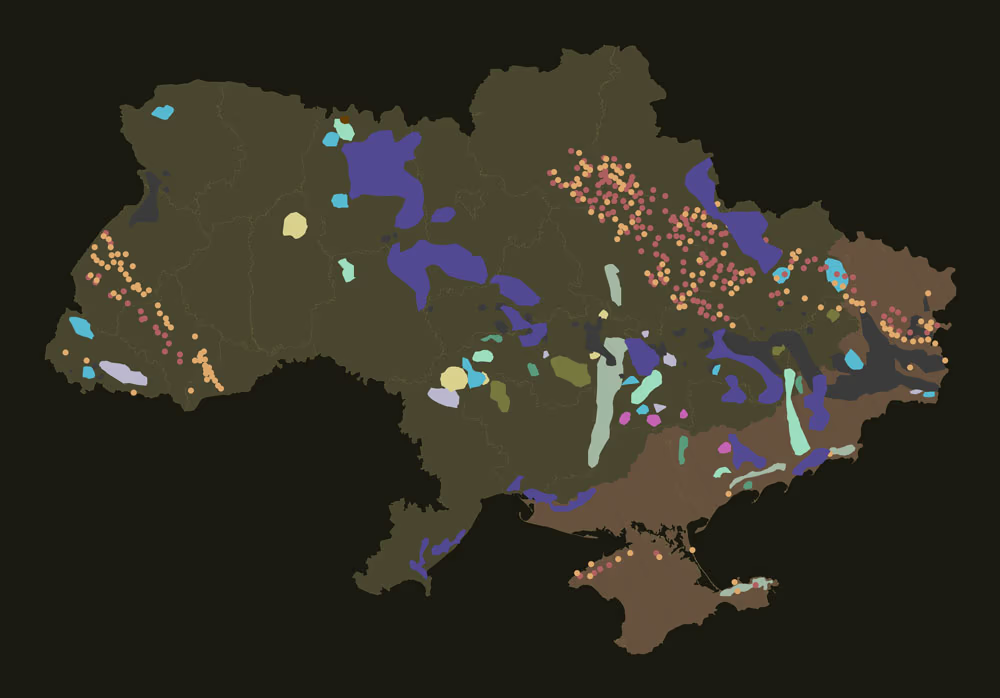

What Is Happening at the Deposits Under Ukraine’s Control That the U.S. Wants to Manage?

The U.S. State Department has stopped supporting the investigation into the abduction of Ukrainian children

This decision will significantly complicate efforts to prosecute Russia for war crimes